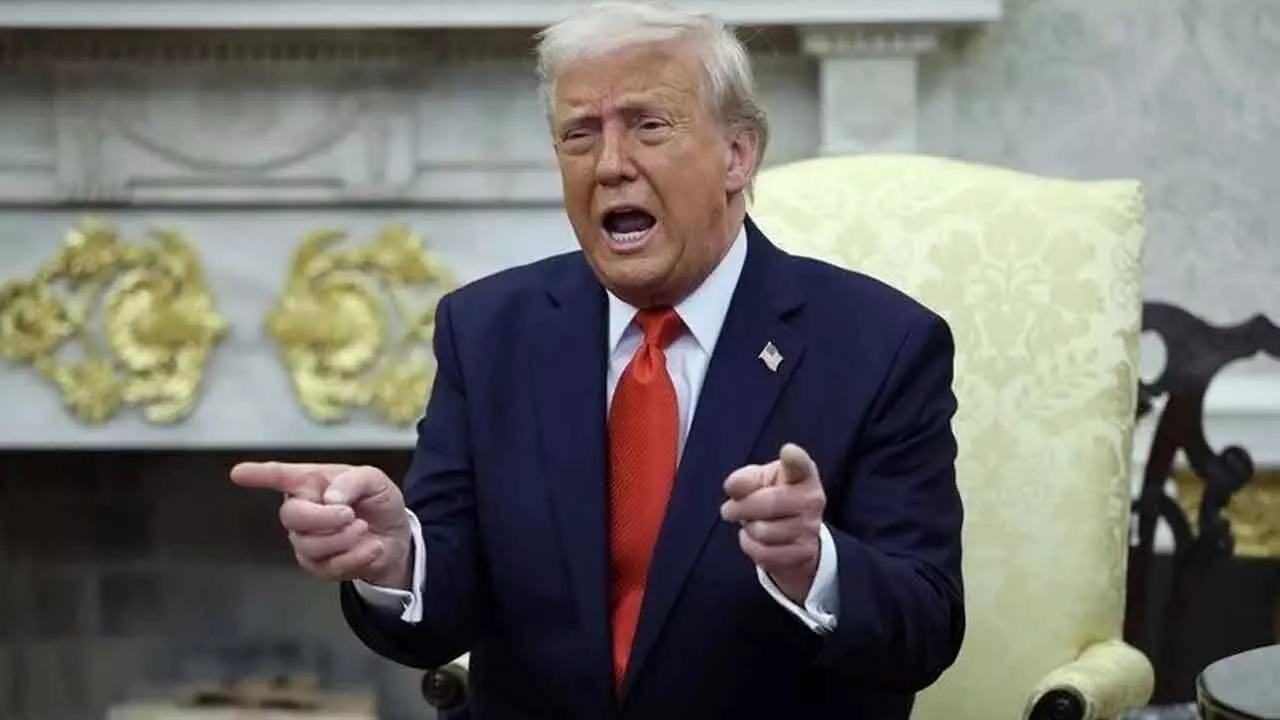

Could Trump Be Leading World Into Recession?

Could Trump Be Leading World Into Recession?

Growth forecasts for the US and other advanced economies have been sharply downgraded by the International Monetary Fund (IMF) in the wake of dramatic swings in US president Donald Trump’s economic policy. But could the uncertainty and the turmoil in financial markets eventually be enough to push the world into a recession?

The IMF says that global growth has already been hit by the decline in business and consumer confidence as “major policy shifts” by the US unfold. These are leading to less spending and less investment.

It also predicts further damage from the disruption in global supply chains and inflation caused by tariff increases. But while the IMF forecasts a sharp reduction in world economic growth in 2025 and 2026, it is not projecting a recession – for now. However, it says the chances of a global recession have risen sharply from 17 per cent to 30 per cent. And there is now a 40 per cent chance of a recession in the US.

The head of the IMF, Kristalina Georgiev, has blamed the slowdown on the ongoing “reboot of the global trading system” by the US. She said this is leading to downgrades in growth estimates, while volatility in financial markets is “up” and trade policy uncertainty is “literally off the charts”.

As part of their forecasts, growth projections for the world’s richest countries in 2025 have been sharply reduced. In the US it is down 0.5 per cent to just 1.8 per cent, while growth in the euro area is projected to be just 0.8 per cent. Japan will be growing by even less at 0.6 per cent. Germany – the EU’s largest economy – is projected to have no growth at all.

And for the UK, growth has been cut by 0.5 per cent, to a very weak 1.1 per cent, which is in line with forecasts from March. This is well below the two per cent projected at the time of the last budget in the autumn. And despite the adjustments made in the UK’s spring statement, the downgrade is likely to mean more tax increases, spending cuts, or both.

Some developing countries are doing much better, with India projected to have one of the highest annual GDP growth rates at 6.2 per cent in 2025. Meanwhile, China’s growth forecast has been cut sharply due to the effect of US tariffs. It is now projected by the IMF to be down by 1.3 per cent to just four per cent.

Other poorer developing countries will also be negatively affected, but most will continue to grow at a faster pace than major industrial nations.

What the forecast underscores is that the era of rapid globalisation, spurred by trade and integration of financial markets, seems to be coming to an end. Its rapid spread since the 1950s, which accelerated in the 1980s, led to a huge expansion of the world economy. But it created winners and losers, both between nations and within them.

The Trump administration’s answer to this is massive tariff increases hitting countries that stand accused of “ripping off America”. The tariffs have several contradictory objectives, including raising money pay for tax cuts; acting as a bargaining chip to open foreign markets to American goods; and encouraging manufacturers to relocate to the US.

Trump has swung between these objectives, and backed down when market reaction became too fierce. These swings have destabilised trade and investment, as well as business and consumer confidence.

Tariffs do not change the fact that many countries can produce the goods Americans want, more cheaply and often more efficiently. And the looming trade war could mean US exporters are hit with retaliatory tariffs, making it even harder to sell American goods abroad.

The inflationary effect of tariffs – raising the price of imported goods – could reverse the recent successes of central banks in taming inflation. It could even force them to raise interest rates – something Trump is fiercely against.

A more immediate effect of Trump’s erratic policy-making has been turmoil in financial markets. The US stock market has fallen sharply since Trump announced his tariff plan, currently down by nearly 15% (a loss of more than US$4 trillion) for shareholders).

Winners and losers:

Attempts at rebuilding a global economic order failed, and other major countries (led by Germany and the US) reverted to autarky, stepping back from the international trading system and worsening the Depression of the 1930s.

Just as Trump is trying to do, countries reverted to competitive devaluations. Each tried to make its exports cheaper than those of its rivals, ultimately to no avail. The world was divided into rival trading blocs, and it is conceivable that the US, the EU and China could form three such blocs in future.

The last financial crisis, in 2008, was mitigated by prompt and cooperative action by central banks and governments.