Retail inflation cools to record low on GST cut

Subdued prices of vegetables, fruits ease price pressure

image for illustrative purpose

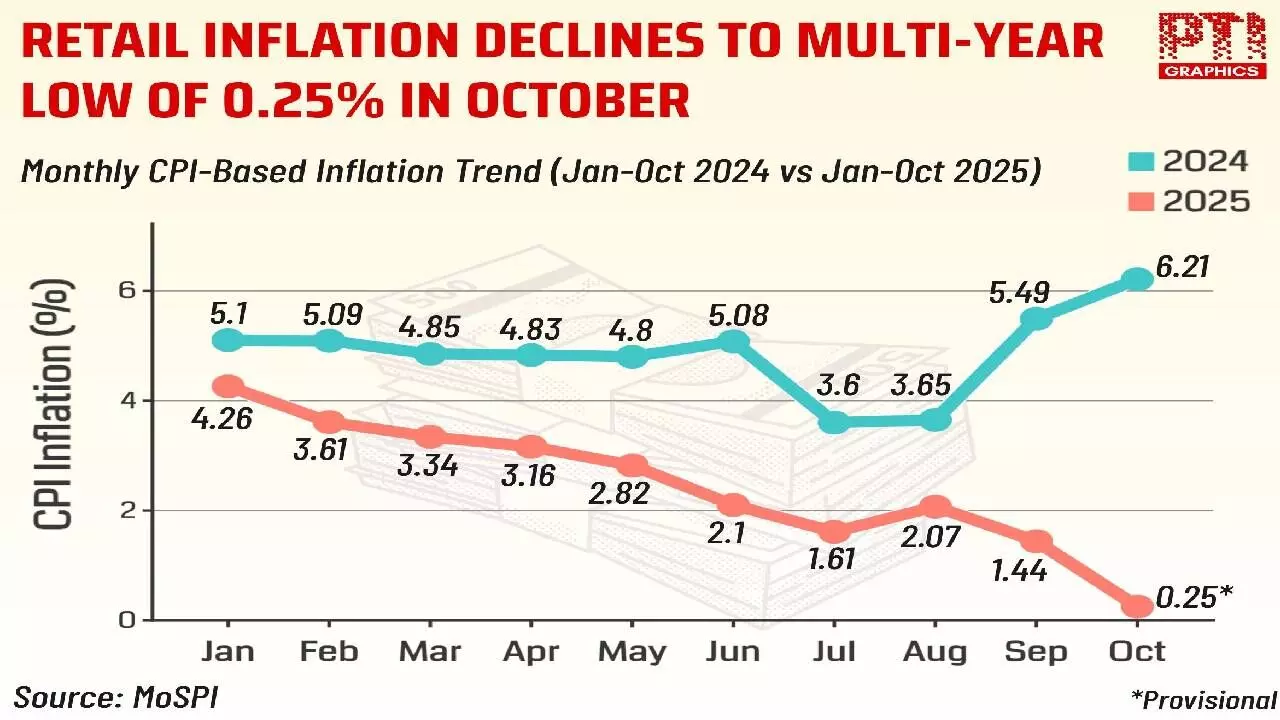

New Delhi: Retail inflation slipped to a multi-year low of 0.25 per cent in October, driven by the impact of the GST rate cut and subdued prices of vegetables and fruits, government data showed on Wednesday.

The consumer price index (CPI) based retail inflation was 1.44 per cent in September and 6.21 per cent in October 2024. According to the data released by the National Statistics Office (NSO), the food inflation declined to (-) 5.02 per cent in October. The decline in headline inflation and food inflation during October 2025 was mainly attributed to the whole month’s impact of GST rate cut, favorable base effect, and a drop in inflation of oils and fats, vegetables, fruits, egg, footwear, cereals and products, transport and communication, the NSO said.

Economists said the further softening of the CPI inflation for the month of October is owing to the government’s prudent GST reforms, which are showing a favourable impact on the economy. The year-on-year inflation rate based on All India Consumer Price Index (CPI) for the month of October stood at 0.25 per cent (provisional).

“The record-low food inflation of the current CPI series at -5.02 per cent (provisional) is the major contributor to lowest headline inflation of the current CPI series,” said Rajeev Juneja, President, PHDCCI.

To further bolster the impact of this period of low inflation, thrust should be laid on building infrastructure and logistics projects, strengthening agriculture supply chains to avoid food price spikes, and prioritizing technology-driven productivity gains in manufacturing and services, he added.

According to Dr Ranjeet Mehta, CEO and Secretary General, PHDCCI, over the next two quarters, “we anticipate that India’s inflation will stay within a manageable range on the back of sufficient food supply, reasonable energy prices, and Reserve Bank of India’s strategic monetary management”.