Why Bali Leads the Real Estate Market Growth Rate – A Complete Analysis for Investors

Bali Leads the Real Estate Market Growth Rate – A Complete Analysis for Investors

Imagine this: a Singaporean couple came across a Bali villa open house in January 2023 and shelled out $320,000 for a three-bedroom house in Umalas. Cut to the present day, and that same villa is now worth $480,000. They're generating approximately $6,500 a month in rental revenue, all while seeing their investment grow at a rate that would make Wall Street analysts green with envy.

Stories like these aren’t anomalies in Bali’s property market—they’re becoming the norm. Over the past two years, the island has quietly transformed into Southeast Asia’s most compelling real estate investment story, delivering returns that leave other tropical destinations looking like mere afterthoughts. According to a spokesperson from Horizon Estate — https://horizonestatebali.com/ — the island's real estate market is poised for steady price growth over the next few years, offering exciting opportunities for investors.

The Tourism Tsunami That Changed Everything

Numbers That Tell the Story

Let's cut the marketing hype and deal with the hard numbers. Bali attracted 6.3 million overseas visitors in 2024, a 144 percent increase from the previous year. But here's the kicker: they're not cheap backpackers. The island has experienced a "demographic revolution," attracting high-end digital nomads, expat families, and luxury travelers who linger and spend more.

Luxury villas in Seminyak and Canggu are now commanding nightly prices in excess of $285, and occupancy is at some 80–85 percent year-round. Top-spending travelers added to length-of-stay bookings translate into rental returns other markets can only fantasize about.

The Digital Nomad Gold Rush

Indonesia's Digital Nomad Visa, introduced in April 2024, was not merely another administrative milestone—it was revolutionary. The E33G visa allows remote workers to remain for up to two years and excludes foreign-earned income from Indonesian taxation. Bali welcomes more than 40 percent of the nation's expatriate community today, which generates consistent demand for everything from co-working–amenable apartments to high-end villas with dedicated home offices.

Stroll through Canggu or Berawa, and you’ll see coffee shops buzzing with laptop-wielding professionals. Villa owners are retrofitting spaces with soundproof work pods and top-tier internet. Bali has become a living, breathing experiment in the future of work—and property owners are cashing in.

Infrastructure: The Billion-Dollar Catalyst

Building Tomorrow’s Bali

Investors need not discount government action. A $1 billion infrastructure initiative through 2029 is changing the island's accessibility and opening up previously inaccessible territory.

The showpiece? North Bali International Airport—a 700-hectare facility that will welcome 32 million passengers annually by 2028. This new airport will turn northern areas such as Lovina and Tejakula from back-of-beyond curiosities into hotspots.

In the meantime, the Bali Light Rail Transit system, arriving in 2027, and the Gilimanuk–Mengwi toll road, cutting travel times right across western and central Bali, will help drive land values up along their courses. And as Starlink begins to island-wide deploy high-speed internet, the digital nomad tide can sweep over every corner of Bali, from rice-field retreats in Tabanan to beachside bungalows in Jembrana.

The Economic Engine Behind the Boom

Riding Indonesia's Growth Wave

The island's real estate boom stands on top of Indonesia's overall economic momentum. The country's GDP is projected to expand 5.2 percent in 2025, and property already accounts for 2.4 percent of GDP. And Jakarta has implemented investor-oriented policies that are too enticing to pass up.

The Golden Visa program, for example, provides 5–10-year residency for a minimum $350,000 investments—property buys are added to that amount. The Second Home Visa provides comparable advantages for above-$126,000 investments. Added to VAT relief on houses below $308,790 and simplified foreign-ownership arrangements through PT PMA, all of these efforts make Bali a magnet for foreign capital.

Property Performance That Defies Gravity

Returns That Speak Volumes

Prices for villas doubled from $321,000 to $484,000 between early 2024 and early 2025—a $163,000 increase in one year. In micro-markets such as Berawa, Canggu, and Pererenan, a select few investors have achieved 20–30 percent year-on-year gains.

On the rental front, luxury villas in prime areas yield 9–15 percent annually, while boutique apartments get 7–12 percent. Compare that with 3–5 percent in Singapore or 4–8 percent in Thailand, and you start to understand why Bali's magic formula is attracting investors by the busload.

How Bali Beats the Competition

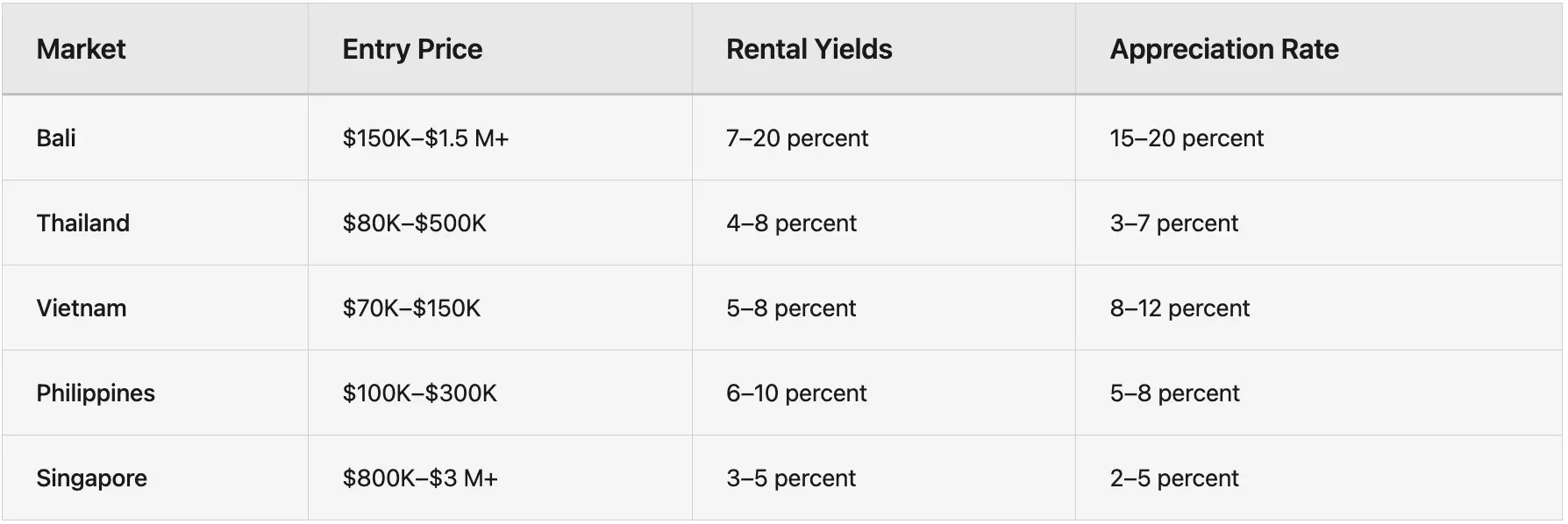

Stack Bali alongside its Southeast Asian neighbors, and the figures paint a stark picture:

Bali provides better risk-adjusted returns in all measures, while providing entry costs that accommodate a broad universe of investors.

The property market in Bali is extremely affordable, with entry-level investments beginning at about $150,000 and going up to more than $1.5 million for high-end assets. Investors in Bali may anticipate net rental yields ranging about 7 percent to 20 percent, and the value of properties generally appreciates about 15 percent to 20 percent per annum.

• It is possible to enter the market in Thailand with $80,000 to $500,000. Rental returns typically range from 4 percent to 8 percent, and annual appreciation varies from 3 percent to 7 percent.

• Lower-cost opportunities exist in Vietnam, with entry costs of $70,000 to $150,000. Rental returns are around 5 percent to 8 percent, and property prices usually increase by 8 percent to 12 percent per annum.

• Philippines entry prices range between $100,000 and $300,000. There, investors generally earn between 6 percent and 10 percent on rental yields, and can expect 5 percent to 8 percent annual price appreciation.

• Singapore's property market is the priciest of the bunch, with prices starting from $800,000 to $3 million or more. Rental returns are limited—about 3 percent to 5 percent—and yearly appreciation usually falls in between 2 percent and 5 percent.

Growth Catalysts Shaping Tomorrow

Sustainable Premiums

Green development isn't a buzzword here—it's a bottom-line motivator. Buildings with green certifications enjoy 12–15 percent price premiums in up-and-coming places like Sidemen.

Mixed-Use Micro-Ecosystems

Say goodbye to freestanding villas. Hottest projects integrate homes with coworking facilities, wellness centers, shopping, and community spaces. These lifestyle compounds have multiple revenue streams and create tenant loyalty.

Strategies That Work

• The Yield Hunter: Focus on rental-ready villas in established hotspots, bank on professional management, and target 1–3 bedroom configurations that appeal to long-stay visitors.

• The Value Creator: Buy under-managed buildings in top micro-locations, spend on design revamp and marketing, and crack 15–25 percent IRRs.

• The Land Banker: Acquire plots along future transit and toll corridors for 20–40 percent upside on a 3–5 year timeframe.

• The Lifestyle Investor: Select properties that serve as personal getaways and rental properties, perfect for remote-working business owners.

Real-World Case Studies

1. Pererenan Pivot: An Australian investor paid $180,000 for three parcels in 2021, put $220,000 into developing them, and watched the portfolio's value increase to $650,000 by 2024—returning a 62.5 percent return along with $8,000 in monthly rents.

2. Seminyak Sophisticate: A foreign investor purchased an old Seminyak villa for $720,000 in 2022, invested $80,000 in a high-end retrofitting, and took home $76,200 in net rental revenues in 2023. Value of property rose to $950,000 by 2024, all before including recurring revenues.

Challenges and How to Navigate Them

Bali’s fame breeds competition. Short-term rental saturation in hotspots has driven RevPAR down 16 percent in early 2025, forcing owners to sharpen marketing and diversify channels. Regulatory changes demand vigilance: nominee structures remain illegal, and local councils are eyeing visitor caps and tourism levies to ease overtourism pressures. Environmental strain—water shortages, traffic gridlock, and cultural clashes—can disrupt operations if unaddressed.

Success depends on active management, indigenous knowledge, and long-term focus. Absentee landlords fail; smart investors establish local teams, secure compliance, and adjust to changing policy.

The Investment Thesis

Now is still the time to invest. Airport and transit projects will unlock new regions by 2028. Visitor projections top 7 million in 2025. Policies continue to grease the wheels for foreign capital. Bali’s market is shifting from opportunistic growth to institutional-grade maturity—professional management, top-tier construction, and careful brand positioning will be table stakes.

The Bottom Line

Bali stands unrivaled as Southeast Asia’s real estate growth leader. With accessible entry points, double-digit yields, and 15–20 percent annual appreciation in prime markets, it outperforms regional peers by a wide margin. But the rewards go to those who do their homework, secure expert local partners, and play the long game. Navigate Bali’s unique blend of opportunity and complexity, and the island offers an extraordinary path to wealth accumulation—one villa viewing at a time.