Low wages trigger attrition at GIC Re

Its 1% expense ratio much better than 9% of LIC; Further, average expense ratio over the wage revision period a meagre 0.94% of the gross written premium as against 15-25% at competitors

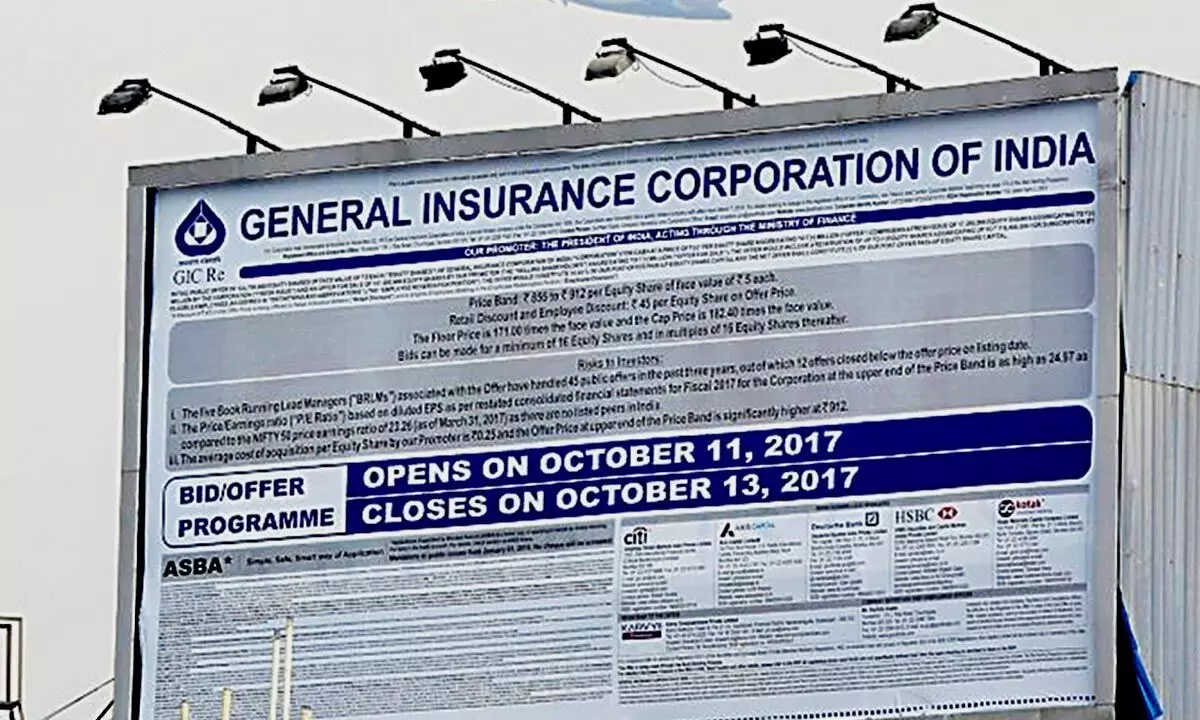

image for illustrative purpose

Working For Peanuts

- Low pay may result in loss of valuable human resources

- It's also leading to loss of business to competitors

- Many key employees joined foreign reinsurers

- IRDAI proposing 30% cap on management expenses for general insurance cos

- However, the cap not applicable to new companies for first 10 yrs

Mumbai: In the last 10 years, between 2012 and 2022, General Insurance Corporation of India (GIC Re) generated humongous net profit of Rs22,290 crore. Further, organisation is running at an expense ratio below one per cent against the LIC running at close to nine per cent.

The management expense ratio for GIC Re is one of the lowest globally across all industries. The average expense ratio over the wage revision period has been a meagre 0.94 per cent of the gross written premium and 0.83 per cent over the previous 10 years. Many investors have expressed surprise over this and have raised queries that why its employees are so underpaid than those of the competitors whose management expenses usually range from 15 per cent to 25 per cent.

This may result in the loss of valuable human resources and thereby business to the competitors, experts point out.

This trend could be seen in recent years as many of the key employees from the corporation joined foreign reinsurers branches based in India and even private insurance companies. Furthermore, at present IRDAI is proposing a cap on management expenses at 30 per cent for general insurance companies. However, this cap is not applicable to new companies during the first 10 years of their operations. GIC Re has been supporting priority sectors like life, agriculture, health, etc., in a big way. It is the biggest capacity provider for central and State government schemes targeted for rural and social sectors which include PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana), PMFBY (Pradhan Mantri Fasal Bima Yojana) and PMJAY (Pradhan Mantri Jan Arogaya Yojana).

For last many years, the insurance major has been the largest agriculture reinsurer in the world. As of now, agriculture, life & health have been major contributors to the total losses that insurance companies incur due to government schemes. Total claims from life, agriculture and health for the period from 2016 to 2022 stood at Rs 78,479 crore as against claims from all segments that stood at Rs 139,966 crs for the same period for Indian business.

When it comes to capacities, various insurance pools have been created to cover unconventional risks, from terrorism to nuclear, and one such pool that has recently been established is the fertilizer pool, which is being created to cover fertilizer and petroleum products imported from Russia and Belarus. Almost in all these pools, GIC Re is the highest stakeholder and also manages these pools efficiently with nominal fees.

A reliable source told Bizz Buzz that compensation structure of GIC Re, despite being similar to that of the PSGICs and LIC's pre-revision structure, has humongous difference when compared with its peer companies like Munich Re, Swiss Re, Hannover and others which operate in the Indian market.

This is evident from the management expenses data provided earlier. This disparity has resulted in a sudden rise in employee attrition over the past four to five years. As per sources, around 90 out of 500 employees has left the organisation, primarily as a result of the compensation structure remaining unchanged since 2012, which has had a negative impact on employees' quality of life. Furthermore, it should be mentioned that 95-97 per cent of employees work in Mumbai Head Office which is infamous for its extremely high cost of living. Due to its low salary structure, GIC Re is becoming a talent breeding ground for the foreign reinsurers operating in India and its competitors, it is said.

Employee unions have repeatedly brought up long-overdue wage revision and other related concerns before management and the Ministry in an effort to resolve the issue. However, neither the management nor the Department of Financial Services (DFS) have provided any assurances as on date in this regard.

Non-revision of wages for such a prolonged period of time has had a considerable negative impact on employees' morale and many of them have started scouting for better employment opportunities.

Furthermore, sources claim that as there is a huge dissatisfaction among employees, this is causing poaching of talented resources by the competitors. As a consequence, performance of the GIC Re could take a hit in the coming years and thereby making the golden goose GIC Re a defunct entity like BSNL and MTNL.