Global growth better than expected but uncertainties remain

Politics will remain a major driver of economic uncertainty in 2024

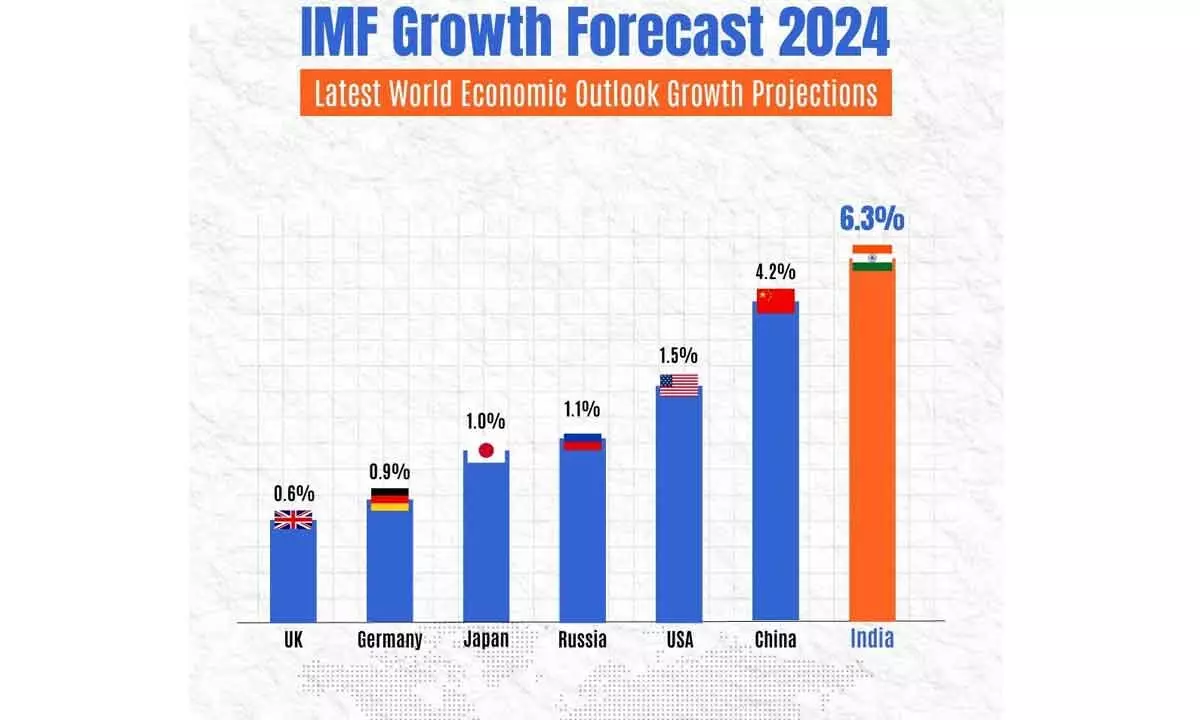

image for illustrative purpose

The travel industry is largely ready to move on from using pre-pandemic trends as a benchmark, according to the survey, with 57 per cent of respondents said that performance comparisons with 2019 are no longer relevant

The dawn of 2024 has shown that the global economy is, in many ways, doing better than expected. In the year gone by, the U.S. not only avoided a recession but grew at a steady clip. Unemployment has been low and, crucially, inflation is falling in most countries.

And yet, the economic outlook remains deeply uncertain. Higher interest rates are grinding their way through the system, wars are wreaking havoc, and climate disasters are becoming commonplace. Suffice to say that the five-year growth prospects for the global economy have never been worse.

The macroeconomic situation in 2024 will remain difficult and uncertain — but there are key themes and questions every business leader should keep an eye on heading into next year. While this analysis is focused on the U.S. economy, many of these same questions apply to much of the world.

Politics will remain a major driver of economic uncertainty in 2024, including the American presidential election, which could have unpredictable consequences for geopolitics, trade, and the wars in Ukraine and the Middle East.

China’s inaccurate data masking sputtering growth, the world’s major shipping companies stopping transit in the Red Sea, and the second largest economy in South America at serious risk of default. And that’s just scratching the surface.

Most travel buyers expect business travel spending and volume to increase this year, with costs ranking as the top concern, according to a Global Business Travel Association poll of 707 travel buyers, suppliers and industry professionals.

The survey covered respondents from around the world. Half of them were travel buyers or procurement professional with 59 per cent of travel buyers stating that they expect business travel volume to increase year over year in 2024. Only nine per cent of the total buyer respondents said that increase would be 20 per cent or more; half said volumes would increase by up to 20 percent; 28 per cent said their business trip volume would remain unchanged from 2023, while 11 per cent said volumes would decrease.

In terms of spending, about two-thirds of buyers said their company would spend more on travel in 2024 compared with 2023—11 per cent of total respondents said that increase would be higher than 20 per cent, while 55 percent said the increase would be 20 per cent or lower. Just over 20 per cent said they expect spending to be flat year over year in 2024, and 12 per cent project a spending decrease.

"As companies and travellers continue to embrace the vital role of in-person connection for business, there are strong indicators for continued growth in travel volume and spending in 2024," GBTA CEO Suzanne Neufang said in a statement. "This bodes well for the future of our industry and its professionals."

Only six per cent of buyers and seven per cent of suppliers said that they expect staffing levels to decrease in 2024 compared with 2023.

Additionally, the travel industry is largely ready to move on from using pre-pandemic trends as a benchmark, according to the survey, with 57 per cent of respondents said that performance comparisons with 2019 are no longer relevant. While about a third of respondents still see value in such comparisons, the pandemic itself ranked at the bottom of respondents' concerns for 2024, according to GBTA.

Government spending needs to focus more on investment in the areas that drive sustainable growth, especially human capital.

Recent OECD PISA scores show educational outcomes are falling, just as the skill needs of the future economy are rising. Public debt levels are generally higher than they were before the pandemic, and in many countries at levels relative to GDP seen before only in wartime. The governments need to adopt sustainable fiscal plans that balance intergenerational needs and prepare economies for the future.

Inflation is projected to be back to target in most G20 countries by the end of 2025. Headline inflation in the G20 economies is projected to drop from 6.6% in 2024 to 3.8% next year, with core inflation in the G20 advanced economies easing to 2.5% in 2024 and 2.1% in 2025.

Monetary policy needs to remain prudent to ensure that underlying inflationary pressures are durably contained. There is a scope to lower policy interest rates as inflation declines, provided the policy stance remains restrictive in most major economies for quite some time to come.

The foundations for future growth need to be strengthened by policy reforms to improve educational outcomes, enhance skills development, and reduce constraints in labour and product markets that impede investment and labour force participation.

Enhanced international co-operation is needed to revive global trade, ensure faster and better co-ordinated progress towards decarbonisation and to alleviate debt burdens in lower-income countries.