DIPAM may call bids for buying RINL-VSP

Tata Steel, JSW Steel, Adani Group names are heard for takeover

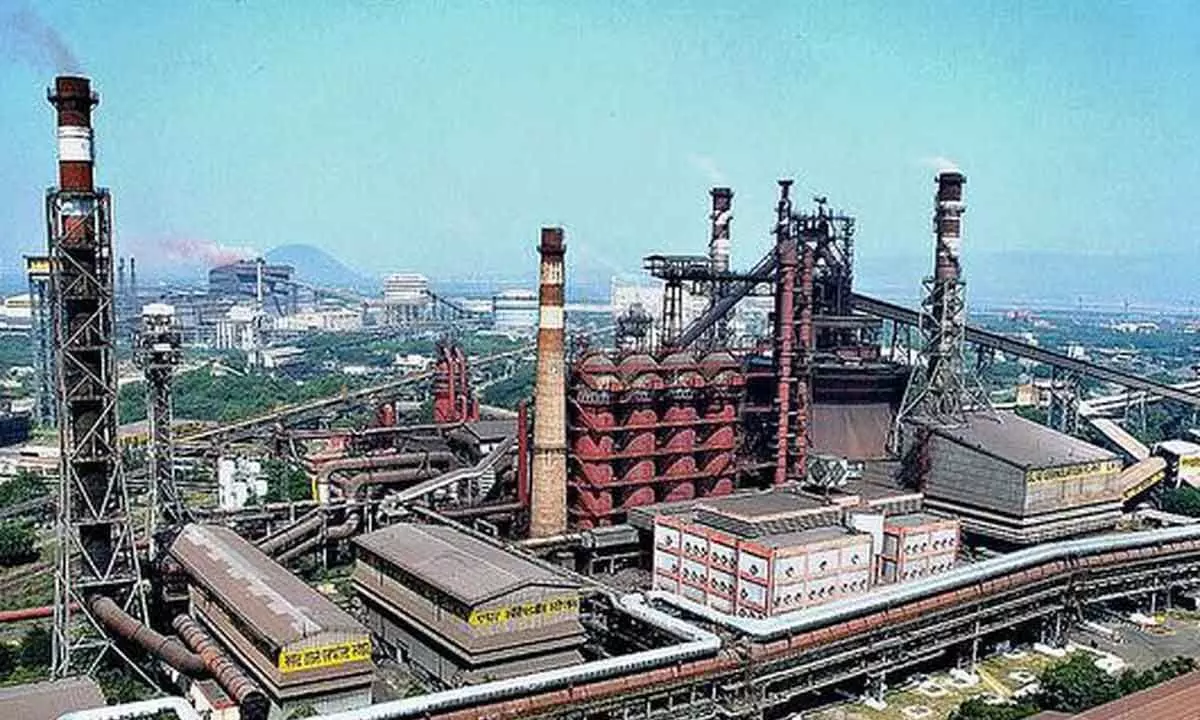

image for illustrative purpose

Visakhapatnam: With the Department of Investment and Public Asset Management (DIPAM) under the Ministry of Finance gearing up to issue notification seeking expression of interest (EOI) bids for acquisition of Rashtriya Ispat Nigam Limited (RINL), the corporate entity of Visakhapatnam Steel Plant (VSP) sometime in January, there is buzz that besides Tata Steel, JSW Steel, Adani Group, which owns Gangavaram Port Limited, may also make a strong pitch to buy the Government of India's shareholding.

There is speculation that going by the massive expansion plan of Adani Group, it may evince interest to make a strong bid for takeover of RINL. Adani Group has already inked a deal with Holcim for $10.5 billion to pick equity in Ambuja Cement and ACC and another for establishing a five million tonne Greenfield steel plant at Mundra in Gujarat with Korean steel giant POSCO for an amount of $5 billion.

"After bulldozing our repeated pleas to explore alternatives to retain RINL in the public sector, it seems the BJP-led NDA government, which is known for its soft corner to billionaire Gautam Adani, may make a strong bidding for acquiring RINL as his Gangavaram Port is located on the backyard of Visakhapatnam Steel Plant," AITUC national general secretary and RINL recognised union leader D Adinarayana told Bizz Buzz on Tuesday.

He said the Adani Group is eyeing the 20,000-acre strong land bank for transforming Gangavaram Port into a premier port and relegating Visakhapatnam Port Authority (VPA), the major port under the Government of India set up in 1933, into a mere landlord port.

He said procuring raw material in good capacity and buying them on time would have increased the earnings, he said while expressing hope that this time, it will narrow down the losses.

The union leader said the company with headquarters in Visakhapatnam earned a profit of Rs 97 crore in 2018-19, loss of Rs 3,900 crore in 2019-20, loss of Rs 790 crore in 2020-21 and a profit of Rs 913 crore in 2021-22.

The company registered a turnover of Rs 28,214 crore in 2021-22 compared to Rs 17,980 crore the previous year. A Union Minister stated in Parliament on March 23 that there is no going back on RINL sale and the company had not increased its profit in the past 10 years and the cumulative loss had gone up to Rs 7,122 crore.

It may be recalled that RINL had enhanced its capacity from three million tonnes to 7.3 million tonnes with a total investment of Rs 12,300 crore.

The Cabinet Committee on Economic Affairs (CCEA) on January 27, 2021 gave approval for strategic disinvestment of RINL by way of 100 per cent privatisation along with Government of India shareholding in its joint ventures and subsidiaries. RINL has already made strategic investment in Bird Group of Companies long ago with the idea to source iron ore from Odisha to meet part of its requirement. However, legal hurdles over unauthorised mining allegedly made before RINL's investment has not so far fetched him any raw material from Odisha.