RBI pleases all with a 'pause'

At a time when global economy is witnessing renewed phase of turbulence followed by latest interest rate hikes by US Fed, BoE and European central banks, Indian banking regulator surprised all stakeholders in India and overseas as well by keeping repo rate unchanged; Experts opine that financial stability concerns appear to have pre-empted a pause as the MPC assesses the impact of its cumulative 250 bps of rate hikes so far

image for illustrative purpose

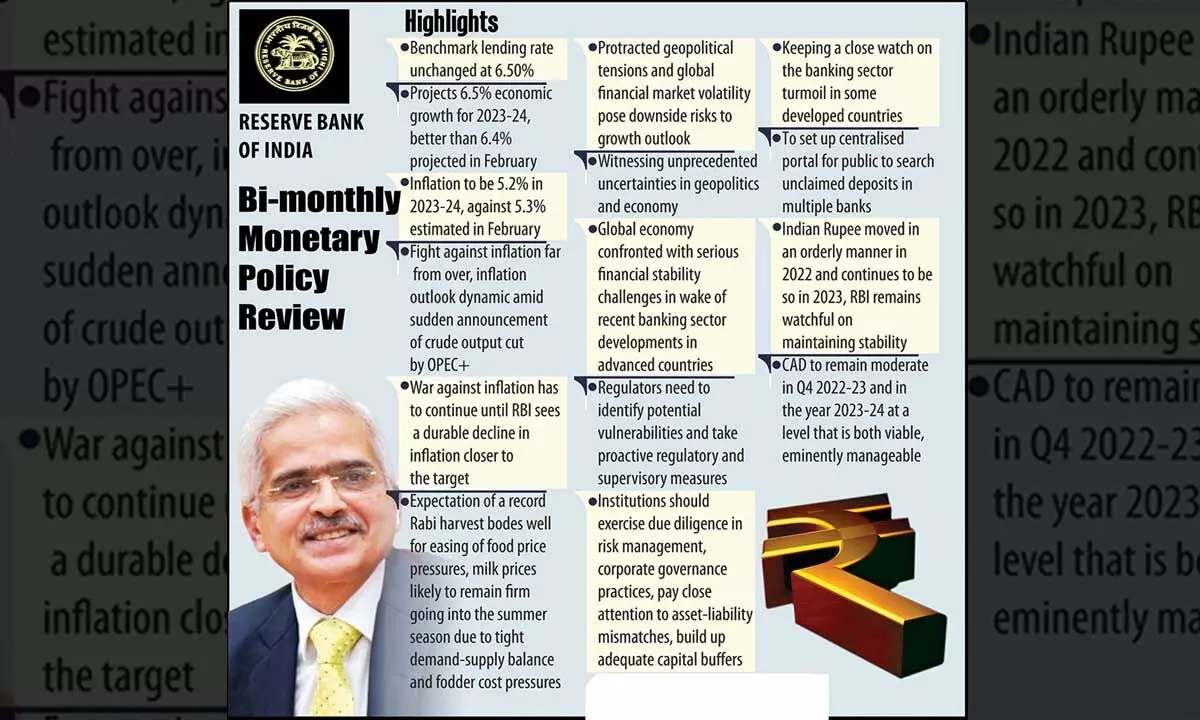

Mumbai: The surprise move on Thursday by the Reserve Bank of India (RBI) to keep key interest rates unchanged, has brought cheers to all the stakeholders. It was widely expected that RBI might go for a 25 basis points hike in key policy rates once again after US Federal Reserve’s recent decision to raise rates by the same measure. However, it didn’t happen post the three-day Monetary Policy Committee (MPC) meeting which concluded here on Thursday morning. The all-important repo rate now remained static at 6.50 per cent as the apex bank stuck to the status quo.

RBI Governor Shaktikanta Das however pledged to hike interest rate again if needed, saying the decision to pause was "for this meeting only". The RBI's six-member Monetary Policy Committee voted unanimously to keep the repurchase or repo rate unchanged at 6.50 per cent. The MPC also decided to retain a policy stance focused on "withdrawal of accommodation" to "ensure that inflation progressively aligns with the target, while supporting growth." That had been its approach since it started tightening in May 2022. "The MPC unanimously decided to keep rates unchanged in this meeting with readiness to act if the situation so warrants," Das said announcing the decisions of MPC. "The MPC will not hesitate to take further action as may be required in its future meetings." RBI has raised interest rate by a total of 250 basis points since May 2022. However, the surprise pause came even as core inflation stayed above 6 per cent for 17 straight months.

Das in his address post MPC meeting said, “The inflation has moderated globally in recent month, but its decent is proving long.” He however agreed that overall inflation was above target. He also said that bank failures have brought contagion risks to forefront. According to RBI Governor, “global economy is witnessing renewed phase of turbulence.”

Reacting to the RBI’s move, Abheek Barua, Chief Economist, HDFC Bank, said: “The RBI successfully delivered a hawkish pause in Thursday’s policy announcement keeping the policy rate unchanged at 6.5 per cent, while keeping the door open for further rate action. The central bank kept its stance unchanged at ‘withdrawal of accommodation’, justifying it by still looming inflationary risks”.

Growth was surprisingly revised upwards to 6.5 per cent for FY24, while inflation forecast for Q4FY24 was revised down –most likely on account of base effects. We expect that growth could be lower at 6 per cent this fiscal, while there are upside risks to the RBI’s inflation forecast, especially given the impending risks around oil prices and the performance of monsoons, he added.

Going forward, the RBI could go for ‘the higher for longer’ narrative - staying on an extended pause in FY24, while tightening liquidity conditions.