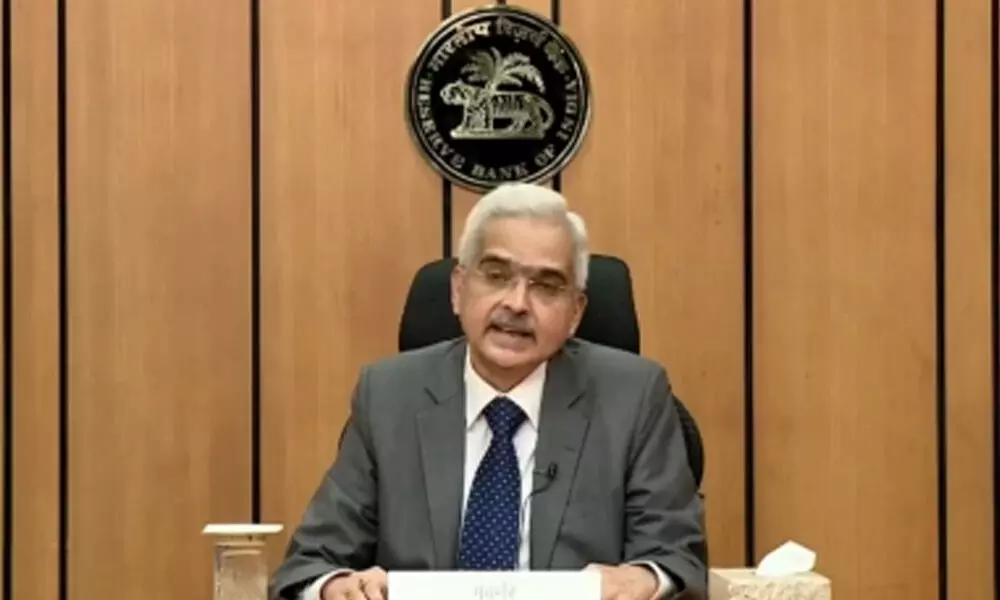

Overarching policy priority now is supporting growth: RBI Guv

Reserve Bank Governor Shaktikanta Das on Wednesday defended the central bank's more-than-anticipated Dovish stance wherein the MPC unanimously voted to continue with an accommodative policy, saying "our overarching policy focus and priority now is supporting growth" amid the threat of a third wave of Covid-19 and the legroom a cooling inflation print offers.

image for illustrative purpose

Fitch cuts India GDP forecast

- Lowers growth rate to 8.4% for FY22 from 8.7%

- Fitch says the bounce was more subdued than it expected in Sept

- The rebound in the services sector was weaker

- RBI keeps growth forecast unchanged at 9.5% for FY22

- Projects GDP growt at 6.6% in Q3 and 6% in Q4

- RBI pegs retail inflation at 5.3% for FY22

- Expects it may inch down to 4 - 4.3% in FY23

Mumbai: Reserve Bank Governor Shaktikanta Das on Wednesday defended the central bank's more-than-anticipated Dovish stance wherein the MPC unanimously voted to continue with an accommodative policy, saying "our overarching policy focus and priority now is supporting growth" amid the threat of a third wave of Covid-19 and the legroom a cooling inflation print offers.

The comments came after the RBI's Monetary Policy Committee (MPC) left the key policy rates unchanged for the ninth time in a row. The repo rate was left at 4 per cent, which was on expected lines, while the reverse repo, which has been the effective policy rate since the pandemic hit in March 2020, was surprisingly kept unchanged at 3.35 per cent despite the central bank preparing the market for a much-needed and delayed rebalancing of the liquidity overdose for quite sometime now. The policy move was predicated on the belief that if the Omicron variant of the coronavirus triggers a third wave of the pandemic in India, it can easily upend the fledgling recovery. Retail inflation is likely to ease to around 5 per cent next fiscal on the back of government measures to ease supplies, reduction in fuel prices and prospects of good crops, Das said. For FY22, retail inflation is pegged at 5.3 per cent and should inch down to 4 - 4.3 per cent by end-FY23. Reduction in excise duty and VAT on petrol and diesel will bring about a "durable reduction in inflation" by way of direct effect as well as indirect effect through lower transportation cost, Das observed.