Adani begins debt buyback

Adani Ports and Special Economic Zone floated a tender to buy back as much as $130 mn of its July 2024 bonds and similar amounts in each of next 4 quarters; It’s in aggregate principal amount of the outstanding 3.375% Senior Notes due 2024

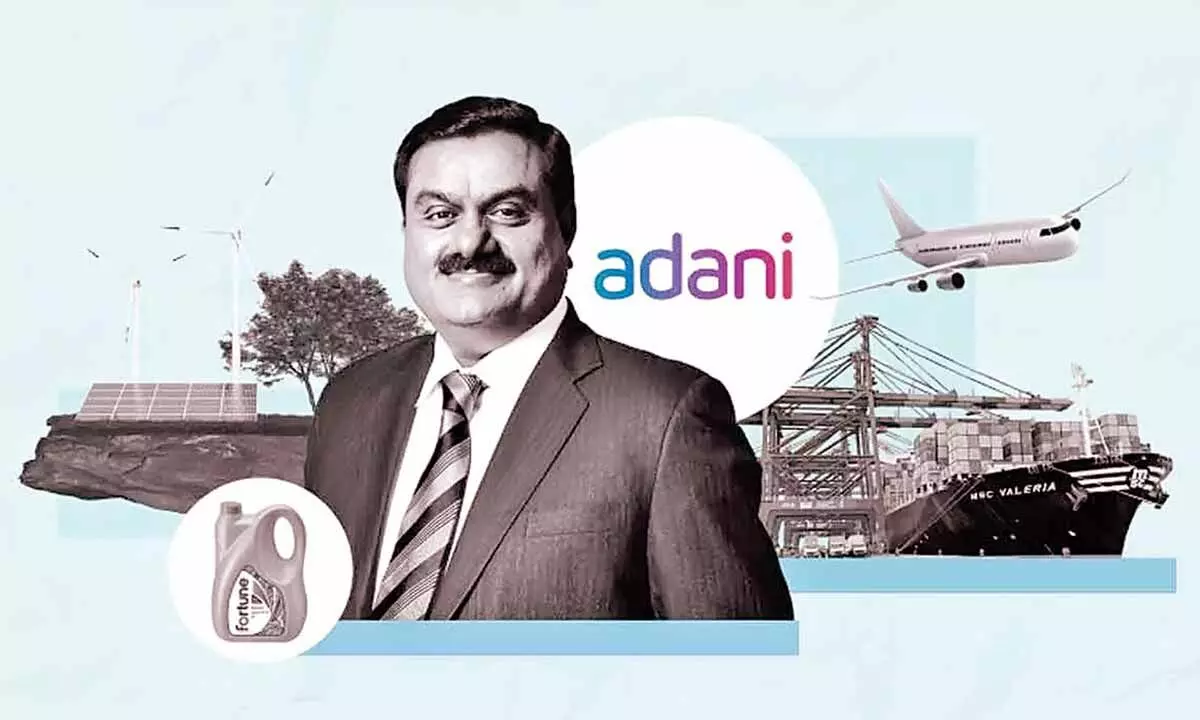

image for illustrative purpose

Liquidity Drive

- Purpose of the tender offer to partly prepay near-term debt maturities

- And also to convey the comfortable liquidity position

- After this Tender Offer, the company expects $520-mn Notes to remain outstanding

New Delhi: Adani Ports and Special Economic Zone (APSEZ) on Monday started the first debt buyback programme since billionaire Gautam Adani’s conglomerate was targeted by a US short-seller in January.

APSEZ floated a tender to buy back as much as $130 million of its July 2024 bonds and similar amounts in each of the next four quarters, it said in an exchange filing, as it looks to regain investor confidence by showing that its liquidity position is comfortable. Shares of Adani group companies pummelled after Hindenburg Research in a January 24 report accused it of accounting fraud and improper use of offshore tax havens for stock manipulation. The group has denied all allegations. APSEZ said it had started a buyback programme for its 3.375 per cent 2024 maturity dollar-denominated bonds.

“The purpose of the tender offer is to partly prepay the company’s near-term debt maturities and to convey the comfortable liquidity position,” it said in a statement.

The company has engaged Barclays Bank, DBS Bank, Emirates NBD Bank PJSC, First Abu Dhabi Bank, PJSC, MUFG Securities Asia Singapore Branch, SMBC Nikko Securities (Hong Kong) and Standard Chartered Bank to serve as dealer managers for the offer.