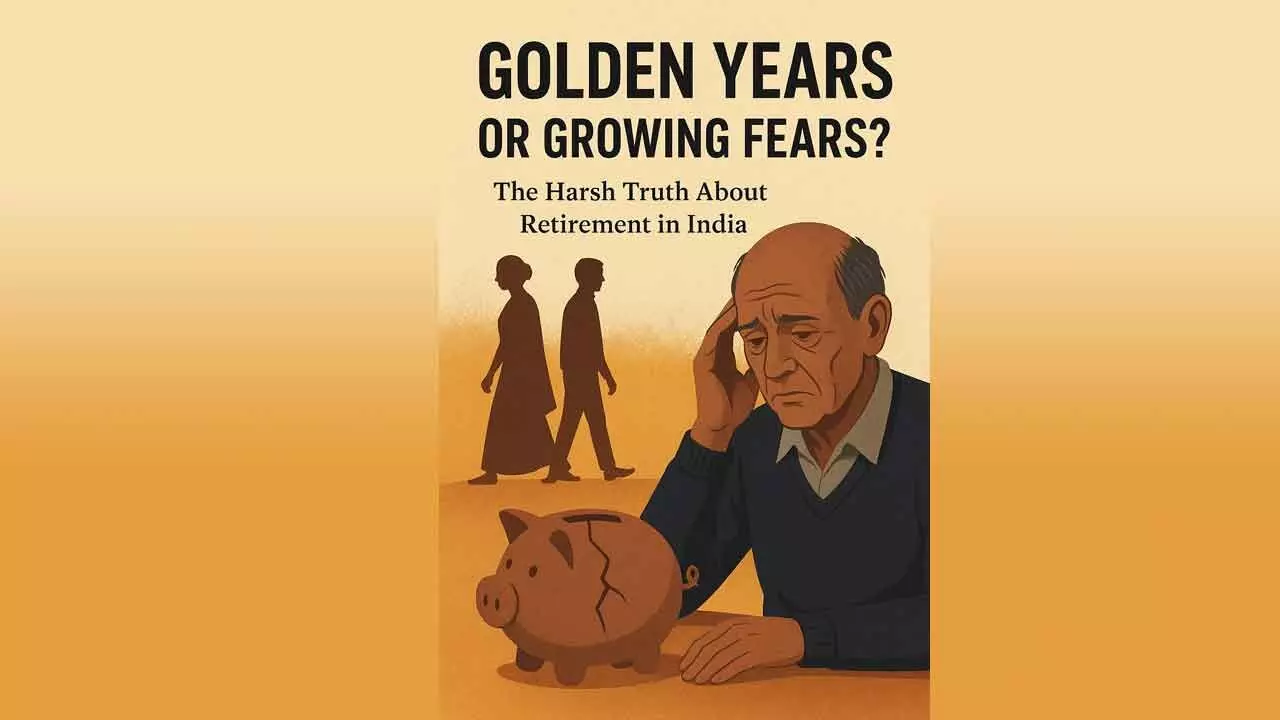

Retirement at risk: India’s grey years need a new game plan

As family support wanes and living costs rise, India’s retirees face emotional and financial uncertainty — demanding urgent policy reform and smarter personal planning

Retirement at risk: India’s grey years need a new game plan

With fragile pensions, delayed withdrawals and vanishing social security, India’s ageing population risks turning its twilight years into a test of survival

Retirement blues for Indians are a common issue stemming from the loss of professional identity, lack of routine, and financial instability, which can lead to feelings of loneliness, uselessness, and anxiety.

To cope, individuals can create a new routine, pursue hobbies, strengthen social connections, seek counseling, and maintain physical activity. Open communication with family is also crucial, as changes in home life can be stressful for all involved.

The truth is that no matter how much you’ve been looking forward to it, retiring from work is a major life change that can bring stress and depression as well as benefits. In fact, some studies have linked retirement to a decline in health.

One ongoing study found that retired people, especially those in the first year of retirement, are about 40 percent more likely to experience a heart attack or stroke than those who keep working.

While some difficulties adjusting to retirement can be linked to how much you enjoyed your job (it’s less of a wrench to give up a job you hated), there are steps you can take to cope with the stress, depression, and other common challenges of retirement.

Whether you’re already retired and struggling with the change, planning to make the transition soon, or facing a forced or early retirement, there are healthy ways to adjust to this new chapter in your life and ensure your retirement is both happy and rewarding.

If your job was physically draining, unfulfilling, or left you feeling burned out, for example, retiring can feel like a great burden has been lifted. But if you enjoyed your work, found it gratifying, and built your social life around your career, retirement can present sterner challenges.

Things can be especially tough if you made sacrifices in your personal or family life for the sake of your job, were forced to retire before you felt ready, or have health issues that limit what you’re now able to do.

Similarly, your outlook on life can also influence how well you handle the transition from work to retirement. If you tend to have a positive, optimistic viewpoint, you’ll likely handle the change better than if you’re prone to worrying or struggle to cope with uncertainty in life.

Employees will be able to withdraw 75 per cent of their PF balance immediately after losing their jobs. Moreover, this 75 per cen amount will be higher than what they could withdraw under the previous rule immediately after job loss. This is because the new rule will allow you to withdraw both from the employee and employer contributions.

The old rule allowed you to withdraw only from the employee’s contribution.

“In case of unemployment, 75 per cent PF balance (that includes employer and employee contributions and interest earned) can be withdrawn immediately.

The remaining 25 per cent can also be withdrawn after one year. Full withdrawal of the entire PF balance (including the minimum balance of 25 per cent) is also allowed in case of retirement after attaining 55 years of service, permanent disability, incapacity to work, retrenchment, voluntary retirement or leaving India permanently etc,” EPFO said.

Why does EPFO need 12 months to give me my own hard-earned money? You may ask.

Retirement planning in India is at a critical juncture, with demographic shifts, economic factors, and societal changes converging to create a complex landscape for individuals seeking financial security in their golden years.

As the world’s second-most populous country undergoes rapid transformation, the challenges in retirement planning have become increasingly pronounced, demanding urgent attention from individuals, financial institutions, and policymakers alike.

The importance of addressing these retirement challenges cannot be overstated. With a growing elderly population and evolving family structures, the traditional reliance on familial support during retirement is no longer a guaranteed safety net.

Coupled with rising living costs, increasing healthcare expenses, and longer life expectancies, the need for robust retirement planning has never been more critical.

Some statistics on Pension Coverage in India reveals that the organized sector is approximately 12 per cent of the workforce. The unorganized sector: Less than 1 per cent have access to formal pension arrangements. Government employees constitute the majority of pension beneficiaries.

The consequences of under-funded pensions are far-reaching: Increased reliance on personal savings and family support; Risk of poverty in old age for a significant portion of the population and Potential strain on government resources to support an aging population.

To address this challenge, there is a pressing need for: Expanding pension coverage, particularly in the unorganized sector; Increasing awareness about the importance of pension contributions; Implementing policies to incentivize higher pension savings.