Audit Services in Dubai: A Practical 2026 Guide for Business Owners (With an Audit-Ready Checklist)

Learn what audit services in Dubai include, how to prepare your business for audits, avoid common mistakes, and choose the right audit firm for compliance and growth.

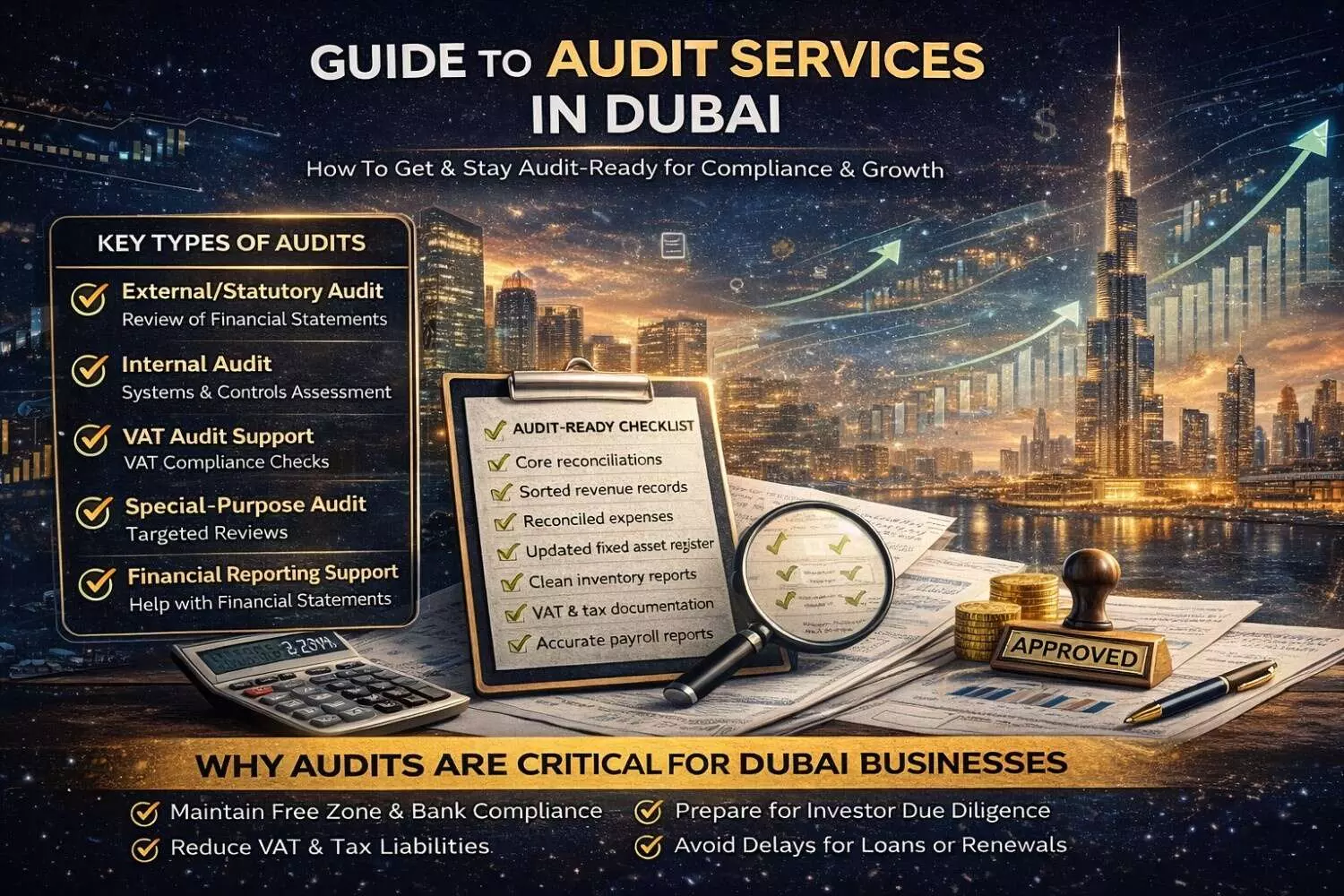

image for illustrative purpose

If you run a company in the UAE, audit services in Dubai are no longer just a year-end formality—they’re a key part of staying compliant, protecting your reputation, and keeping your business “bank-ready” and investor-ready. Whether you’re in a free zone, on the mainland, or expanding across multiple emirates, a clean audit trail can reduce risk, speed up approvals, and stop surprises from popping up at the worst possible time.

This guest post breaks down what audit services in Dubai typically include, how to prepare properly, and how to choose the right audit partner—without drowning in jargon.

Why audit services in Dubai matter more than most SMEs think

Many business owners see the audit as a “report we must submit.” In reality, an audit is a structured review of how your financial statements were built, what evidence supports them, and whether they fairly reflect your company’s performance and position.

In Dubai, audits often become important for:

Free zone renewals and compliance (requirements can vary by authority)

Banking and credit facilities (banks often ask for audited financials)

Investor discussions, partnerships, and due diligence

Internal governance (especially once you scale beyond a small team)

Reducing tax/VAT risk by maintaining a defensible paper trail

Think of it like this: when your records are audit-ready, your business can move faster.

What “audit services in Dubai” usually include

Different firms package services differently, but most audit service providers in Dubai offer a combination of the following:

1) External / statutory audit

This is the classic year-end audit of your financial statements. Auditors test samples of transactions and balances and issue an opinion based on evidence.

Best for: companies that require audited financial statements for licensing, renewals, or stakeholders.

2) Internal audit

Internal audit focuses on systems and controls—how money flows, where risk sits, and what could break when the business grows.

Best for: fast-growing SMEs, multi-branch operations, companies with high transaction volume, or teams that want stronger governance.

3) VAT-related audit support and compliance review

Not a “VAT audit by the government,” but a proactive check of your VAT reporting process and documentation to help reduce exposure.

Best for: companies with complex invoicing, imports/exports, mixed supplies, or frequent adjustments.

4) Special-purpose audit and agreed-upon procedures

Sometimes you don’t need a full statutory audit—you need a targeted review for a bank, investor, acquisition, or regulator.

Best for: fundraising, M&A, banking applications, or regulatory submissions.

5) Financial reporting support

Some businesses also need help with financial statement presentation, schedules, and clean close processes—so the audit doesn’t turn into a “rebuild our accounts” project.

Best for: SMEs that have bookkeeping, but lack structured month-end closes and reconciliations.

The real goal: become audit-ready (not just “audit done”)

A smooth audit is typically the outcome of three habits:

Monthly discipline (reconciliations, clean close, documented support)

A single source of truth (organized documentation and approvals)

Management review (someone responsible for the numbers—not just the software)

If those three exist, the audit becomes a verification exercise—not an emergency rescue mission.

Audit-Ready Checklist (Use this 30–45 days before year-end)

Below is a practical checklist you can copy into your internal SOP.

A) Core reconciliations (non-negotiable)

Bank reconciliations completed for every account (monthly, not yearly)

Unreconciled items reviewed, explained, and resolved

Petty cash reconciled (if you use it)

Loans and interest schedules matched to statements

B) Revenue and receivables

Signed contracts / proposals / scope documents stored centrally

Revenue recognition logic documented (especially for milestone work or retainers)

Accounts receivable aging reviewed; disputes documented

Credit notes backed by approvals and clear reasoning

C) Expenses and payables

Supplier statements reconciled where possible

Accruals recorded for services received but not yet invoiced

Large or unusual expenses supported by contracts/quotes/approvals

Related-party expenses clearly labeled and supported

D) Inventory (if applicable)

Stock count performed and signed off

Cut-off tracked (goods in transit, returns, year-end deliveries)

Obsolete/slow-moving stock reviewed and adjusted if needed

E) Fixed assets

Fixed asset register updated (additions, disposals, depreciation)

Asset purchases supported by invoices and capitalization rationale

Disposal documents maintained (sale, scrap, approvals)

F) Payroll and employee liabilities

Payroll reports reconciled to the ledger

Leave balances and gratuity/end-of-service workings maintained

Employee contracts and allowance structures accessible

G) VAT and documentation quality

VAT returns reconciled to ledger balances (output/input VAT)

Tax invoices checked for completeness and consistency

Imports/exports documentation filed and easy to retrieve

H) Management review pack (the thing most SMEs skip)

Trial balance review (unexpected balances, large movements, negative balances)

Analytical comparison vs last year and vs budget

Notes on one-off transactions and judgment areas (provisions, accruals, write-offs)

Common mistakes that delay audits in Dubai

If your audit keeps dragging on, it’s usually one of these:

Bank recs done late (and missing supporting explanations)

Revenue not backed by contracts (or delivery proof not consistent)

Accruals ignored (so liabilities are incomplete)

VAT reports not tied to the ledger (numbers don’t reconcile)

“Dropbox chaos” (documents scattered across emails and WhatsApp)

Fixing these doesn’t require a “big finance team.” It requires process.

How to choose the right audit partner (without overpaying)

When evaluating audit services in Dubai, focus on fit—not just brand names.

Ask these practical questions:

Do they understand your business model (services vs trading vs e-commerce)?

Will you get a clear PBC (Provided By Client) list and timeline upfront?

Who will actually manage the engagement day-to-day?

How do they handle messy records—do they advise on clean-up, or just flag issues?

Can they support you beyond the audit if you need it (tax/VAT advisory, reporting)?

Red flags to avoid:

Vague scope (“we’ll see once we start”)

No structured document request list

Overpromising unrealistic timelines with no process

Poor communication (slow replies early = slower audit later)

A smart add-on: align audit readiness with cashflow planning

Here’s an overlooked angle: audit-ready businesses also tend to have cleaner cashflow forecasting. Why?

Because reconciliations, accurate receivables, proper accruals, and disciplined reporting directly improve your ability to plan: hiring, expansion, inventory, marketing budgets, and debt repayments.

That financial discipline isn’t just for the company—it can also help founders and expat employees manage personal commitments. For example, if you’re a UK graduate living in Dubai and want to understand how student loan deductions may affect long-term take-home pay (especially if you return to the UK later), tools like Student Loan Calculator UK can help you map repayments and plan confidently alongside your broader financial goals.

Final takeaway

The best audit outcome isn’t just an audit report—it’s a business that runs with clarity, documentation, and control. If you treat audit services in Dubai as part of your operating system (not a once-a-year pain), you’ll reduce compliance risk, speed up approvals, and make your company more attractive to banks, investors, and partners.

If you want support from a team that works with UAE businesses across common audit and compliance needs, you can explore Audit Firms Dubai for an overview of services and guidance.

Author Note (optional for publishing):

This article is intended for general informational purposes and does not constitute legal or tax advice. For advice specific to your entity type, jurisdiction, and industry, consult a qualified professional.