PM launches two innovative customer centric initiatives of RBI

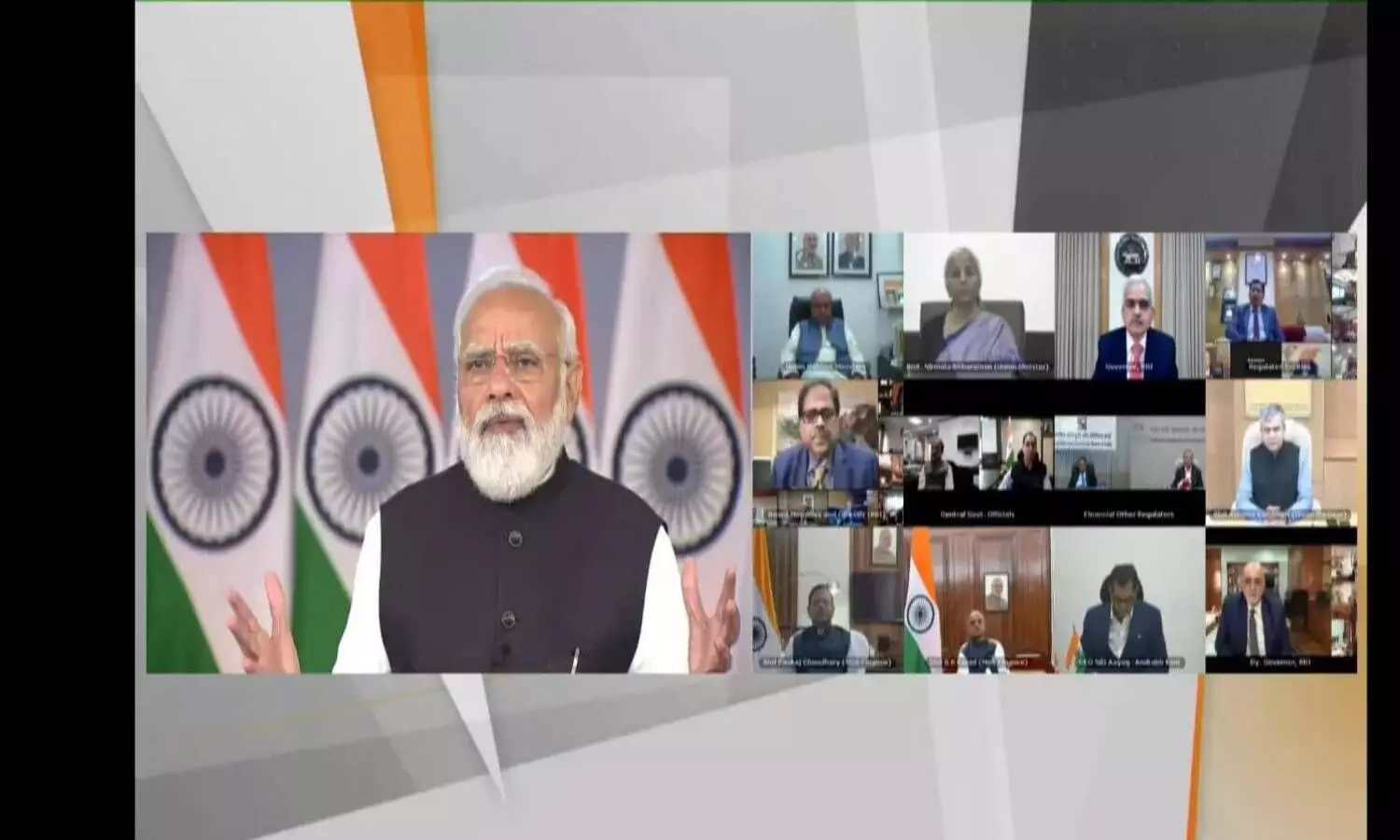

Prime Minister, Narendra Modi today launched two innovative customer centric initiatives of RBI

image for illustrative purpose

Mumbai, Nov 12 Prime Minister, Narendra Modi today launched two innovative customer centric initiatives of RBI. They include Retail Direct Scheme and Integrated Ombudsman Scheme.

Addressing on the occasion, the PM said, "Retail Direct Scheme will give strength to the inclusion of everyone in the economy as it will bring in the middle class, employees, small businessmen and senior citizens with their small savings directly and securely in government securities."

Retail Direct scheme will facilitate the retail investors to put in their hard-earned money directly into government securities. The facility is available for free.

The PM said that one of the biggest touchstones of a democracy is the strength of its grievance redressal system. The Integrated Ombudsman Scheme will go a long way in that direction.

Retail Direct Scheme will give strength to the inclusion of everyone in the economy as it will bring in the middle class, employees, small businessmen and senior citizens with their small savings directly and securely in government securities, he said.

Due to government's measures, the governance of banks is improving and the trust in this system is getting stronger among the depositors.

According to PM, in just 7 years, India has jumped 19 times in terms of digital transactions. Today our banking system is operational 24 hours, 7 days and 12 months anytime, anywhere in the country.

Commenting on it, Nitin Shanbhag, Sr Executive group VP- Motilal Oswal Private Wealth, said, "The G-sec market is dominated by Institutional investors like Banks, Insurance companies and Mutual Funds with lot sizes of Rs 5 crore & higher. Hence this segment was largely inaccessible to retail participants. G-secs witnesses highest volumes within the fixed income market since they offer a risk-free rate, hence no credit risk. Retail investors could thus far participate in G-secs only through Debt Mutual Funds, although with limited options.

Further, in Debt funds, investors have to invest with a minimum 3-year investment horizon through the Growth option to qualify for long term capital gains @20 per cent with indexation benefit. The RBI Retail Direct Scheme will enable retail investors to participate into G-secs across various tenors with flexible investment horizons and with the ability to get regular cash flows through risk-free coupons."