Inflation lingers once again, but it is not clear if it is transitory: RBI Deputy Guv

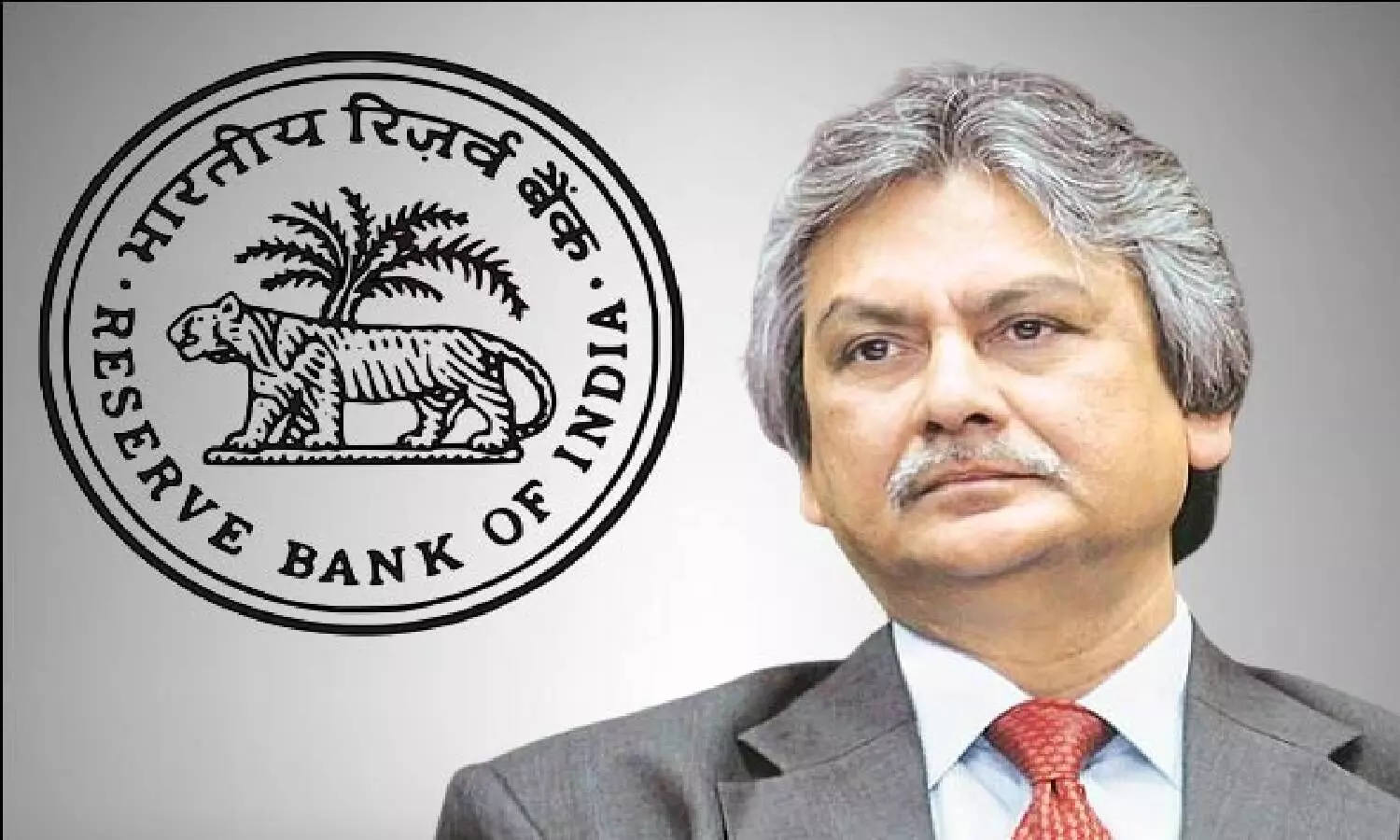

image for illustrative purpose

Mumbai Inflation that checked in on the back of elevated commodity prices and supply disruptions induced by the pandemic, lingers and the jury is still out on whether it is transitory or persistent, said RBI deputy governor, Michael D Patra. He was addressing a CII summit.

According to Patra, monetary policy has been on a prolonged pause in terms of the policy rate after reducing it to its lowest level ever. The stance of 'as long as necessary' accommodation is reflected in ample liquidity in the system, with net surpluses of close to Rs 9 lakh crore being absorbed by the RBI on a daily basis. Markets are, however, constantly reassessing this stance with incoming data and seek definitive reassurance on the future course of policy.

Five years ago, India instituted a flexible inflation targeting (FIT) framework as its monetary policy regime.

Commenting on it, he said, "I recall that at that time there were widespread misgivings in public discourse and within the RBI. It was perceived as a blinkered monetary authority pursuing a narrow inflation target single-mindedly and at the cost of societal objectives when a full- service central bank reflected the aspirations of the nation. The actual experience with FIT in India has exorcised that spectre."

In 2019-20, the Indian economy was into a downturn which had been maturing over the past few years, taking down real GDP growth to 4 per cent which is the lowest in the decade of the 2010s. The MPC had launched into an easing cycle from February 2019 to stimulate economic activity – preceded by rate reductions, the term accommodative was first articulated in the monetary policy stance in June 2019. As soon as the World Health Organisation (WHO) declared COVID-19 as a pandemic in March 2020, the MPC in off-cycle meetings pre-emptively reduced the policy rate by 115 basis points to its lowest level ever. In sync, the RBI infused massive amounts of liquidity cumulating to 8.7 per cent of GDP and undertook several so-called unconventional measures to reach out to specific sectors, institutions and market segments. Inflation had averaged 4.8 per cent in 2019-20; although above target, it was well within the tolerance band and stemmed from a narrowly based food price shock. This was the first use of flexibility pre-emptively under the new framework – the MPC judged that inflation was tolerable, affording policy space to address the more immediate threat to growth.

As may be recalled, the pandemic's first wave brought the economy to a standstill, crippling almost all aspects of activity and even mobility. A casualty was the collection of price quotations for compiling consumer price index (CPI) inflation, the metric by which the framework is evaluated. Imputations had to be resorted to and this was regarded as a break in the CPI series. In the process, an upside bias was built into data when they started getting collected and compiled from June 2020. As the pandemic intensified, supply and logistics disruptions became severe, mark-ups rose to claw back lost incomes and taxes on petroleum products were increased.

Driven up by this unprecedented vortex of forces impacting together, inflation breached the upper tolerance band in the second and third quarters of 2020-21, averaging 6.6 per cent. This experience demonstrated yet another aspect of the "F" in FIT – in view of GDP contracting by 24.4 per cent in the first quarter and by 7.4 per cent in the second, the MPC could afford to stay its hand despite two continuous quarters of deviation from the tolerance band and look through an inflation episode which was obviously driven by transitory factors. I do not want to dwell on a hypothetical 'what-if' scenario in which the MPC, concerned about two quarters of deviation and impending accountability failure, would have reacted by raising the policy rate. That would have been disastrous for India, he said.

The MPC's call turned to be correct. In the fourth quarter of 2020- 21, the usual seasonal moderation in food prices came into play and, along with some improvement in supply conditions as the economy unlocked, inflation eased to an average of 4.9 per cent. Congenial financial conditions engendered by monetary policy helped to revive the economy. Growth emerged out of a technical recession in the third quarter and in the fourth, it regained positive territory. Looking back, it was the combination of framework flexibility and astute judgement that healed the economy and helped it rebound, he said.

A less compelling point is that VRRRs are effectively a way of remunerating excess reserves, thereby injecting additional liquidity into the system. It is not, and I would emphasize this, it is not a signal either for withdrawal of liquidity or of lift-off of interest rates. Signals of the latter will be conveyed through the stance that

is articulated by the MPC in its future resolutions. We don't like tantrums; we like tepid and transparent transitions – glidepaths rather than crash landings.

The outlook is overcast with the pandemic. Future waves may have to be navigated on the voyage beyond into a world that can live with COVID-19 without loss of life and livelihoods. On this journey, the course of monetary policy will be shaped by the manner in which the outlook for growth and inflation evolves.

For the economy as a whole, the output gap - which measures the deviation of the level of GDP from its trend – is negative and wider than it was in 2019-20. Given these developments and with the GDP outcome for the first quarter coming in just a shade below the RBI's forecast, the projection of growth of 9.5 per cent for the year as a whole appears to be on track. Even so, as Governor Shaktikanta Das pointed out in a recent interview, the size of the economy would just

about be exceeding the pre-pandemic (2019-20) level.

In the MPC's assessment, inflationary pressures are largely driven by supply shocks. Although shocks of this type are typically transitory, the repetitive incidence of shocks is giving inflation a persistent character. Contributions to inflation are emanating from a narrow group of goods – items constituting around 20 per cent of the CPI are responsible for more than 50 per cent of inflation. The analysis of inflation dynamics indicates that the easing of headline inflation

from current levels is likely to be grudging and uneven.

The MPC remains committed to its primary mandate of price stability, numerically defined as 4 per cent with a tolerance band of +/- 2 per cent around it. Taking into account the outlook on growth and inflation and keeping in mind the inherent output costs of disinflation, it is pragmatic to envisage a glidepath along which the MPC can steer the path of inflation into the future. The MPC demonstrated its commitment and ability to anchor inflation expectations around the target of 4 per cent during 2016- 20. Confronted with a once-in-a-century pandemic, the MPC had to tolerate higher average inflation of 6.2 per cent in 2020-21. The envisaged glidepath should take inflation down to 5.7 per cent or lower in 2021-22, to below 5 per cent in 2022-23 and closer to the target of 4 per cent by 2023-24. The rebalancing of liquidity conditions will dovetail into this glidepath, but the choice of instruments is best left to the judgment of the RBI with its considerable experience with such tapers.