The Israel-Hamas crisis can strengthen Indian economy

Though the conflict is not affecting India's trade with Israel, its escalation could impact supplies

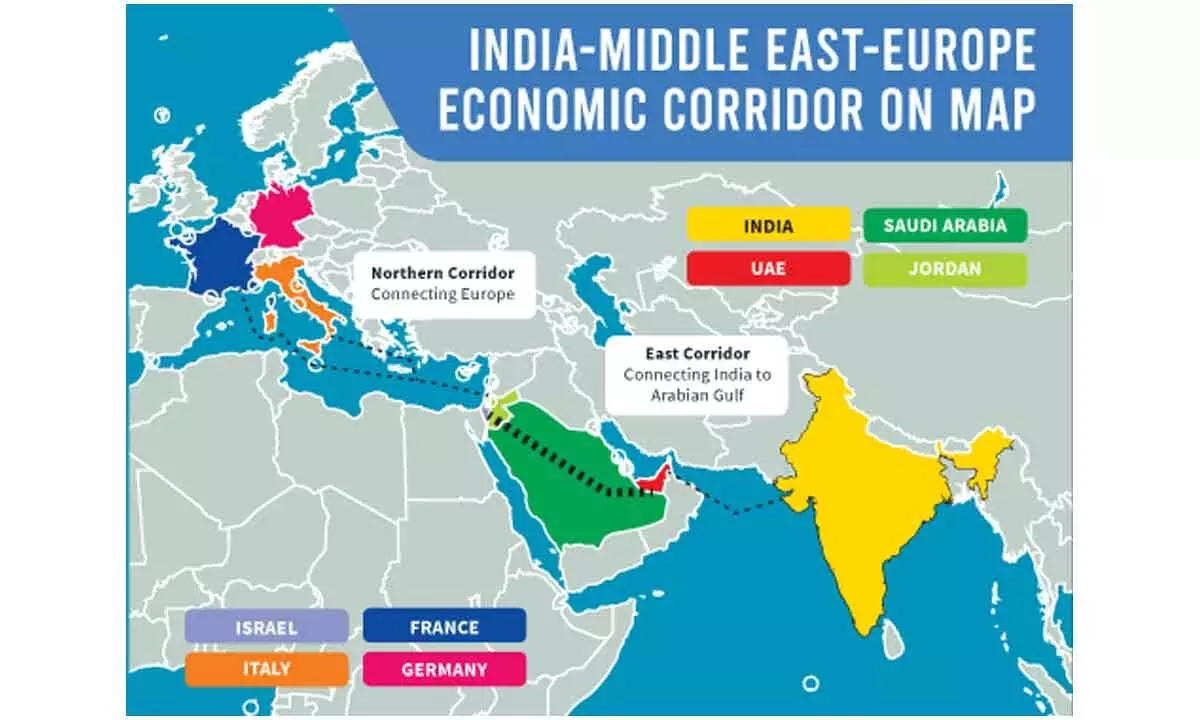

image for illustrative purpose

Going by the opinions of political experts, there appears to be an elevated probability of around 70 per cent or above of the conflict drawing militant groups from other nearby countries. This simply means that the trade disruption as feared by the markets would take place. As a result, crude and commodity prices that move through the sea-route are likely to be the first to be impacted

Even as it is a difficult task to assess the impact of the ongoing Israel-Hamas war on the country’s economy, the one thing that becomes crystal clear is that India is likely to be thea gainer despite costlier crude oil and sliding INR against the Greenback.

The International Monetary Fund (IMF) forecast is that it is likely to cross the mark of 2.9 per cent as against the target of three per cent.

In contrast, India continues to enjoy relative macroeconomic stability but is vulnerable to one key risk - supply disruption in crude oil prices because of escalation in the war, resulting in a spike in crude oil prices.

High crude oil prices will impact currency stability (making imports expensive), possibly worsening the government’s fiscal deficit (the government is likely to absorb higher prices by cutting excise duty), widening the CAD and affecting the profit margins of sectors like aviation, paints, tyres and chemicals.

“All these implications could have a negative impact on economic growth in the short term, as high inflation and low profitability in various sectors would hit disposable incomes and discretionary spending,” Shantanu Bhargava, Managing Director, Waterfield Advisors told Bizz Buzz.

The conflict is not affecting India's trade with Israel immediately. Should the battle escalate, supply-side issues may arise. India's 1.8 per cent merchandise exports to Israel are mostly petroleum products. Israel imports $5.5–6 billion in refined hydrocarbons from India. India's exports to Israel were $8.4 billion in FY23. India imports equipment, pearls, diamonds, and other precious and semi-precious stones from Israel. India imported $2.3 billion from Israel in 2023.

The market’s logic is quite similar to the Russian Ukraine war. Crude is up nearly seven per cent and gold by 5.5 per cent since October 5.

Going by the opinions of political experts, there appears to be an elevated probability of around 70 per cent or above of the conflict drawing militant groups from other nearby countries. This simply means that the trade disruption as feared by the markets would take place. As a result, crude and commodity prices that move through the sea-route are likely to be the first to be impacted. It is noteworthy that 30 per cent of India’s imports are crude-linked and input costs of companies are linked to commodity price pressures. Above all, there is an apprehension of broad market volatility.

India is all set to join the top three economy club in the near future. The reason is simple. There have not been any such major disturbances in India and the entire world, particularly post-Covid, is looking at India now for trade pacts.

JP Morgan has made a bold forecast while saying that India is all set to become third largest economy by 2027 by crossing the GDP of $ seven trillion.

In fact, James Sullivan, the managing director of Asia Pacific Equity Research at JP Morgan sees Indian economy doubling to $ seven trillion by 2030 with contribution from manufacturing rising to nearly 25 per cent from 17 per cent and exports doubling , to over $trillion.

Indian economy has rather hiked its growth forecast from 6.1 to 6.3 per cent for the current year in the recent past. Apart from it, this market is the fastest growing in the world for the second consecutive year. Ironically, China’s growth has been forecast to reach five per cent during the same periods.

Now comes the action taken by the Federal Reserve, which has indicated that it will pause its cycle of rate hike as inflation levels are gradually coming nearer to target levels. India has been monitoring the global situation in West Asia with concern to assess any potential fallout on the domestic economy.

It becomes evident from the concern expressed by RBI Governor Dr Shaktikanta Das about the slowdown in external environment. He warned of headwinds from geopolitical tensions that could upset the economic outlook.

Whatever be the case, a prolonged conflict in western Asia could have adverse impact on the domestic economy. Merchandise exports sector has not been growing as fast as others. During the first five months of the current fiscal, total merchandise exports reached $172.95 billion when compared to $196.33 billion in the year-ago period. It has happened because of the slack in demand from Europe and the US which are passing through recessionary phases. Incidentally, even the services sector is moving southwards.

The second major concern is in the form of oil imports. For the records, India imports 85 per cent of its fuel requirements. The oil prices have been volatile globally from the time the Ukraine crisis erupted. It is a different thing that the price moderated in between. However, in case the ongoing Israel-Hamas crisis prolongs, which is likely, prices may start soaring.

The external headwinds caused by the geo-political tensions apart, domestic indicators are pointing towards a bright outlook in terms of growth for the current fiscal. Initially, then the news of the current disturbance in the West Asia started pouring in early October, the domestic market started correcting itself. However, within a short while, the market was able to recover thanks to positive quarterly results by the corporates.

In fact, the second quarter for the corporates is also expected to bring better financial results for the corporates. Demand is also picking up in other sectors like passenger cars and FMCG among others.