RBI decision to hike ICRR surprises stakeholders; bank justifies ‘appropriate’ move

Currency off-take likely to shoot up in the ensuing festive season

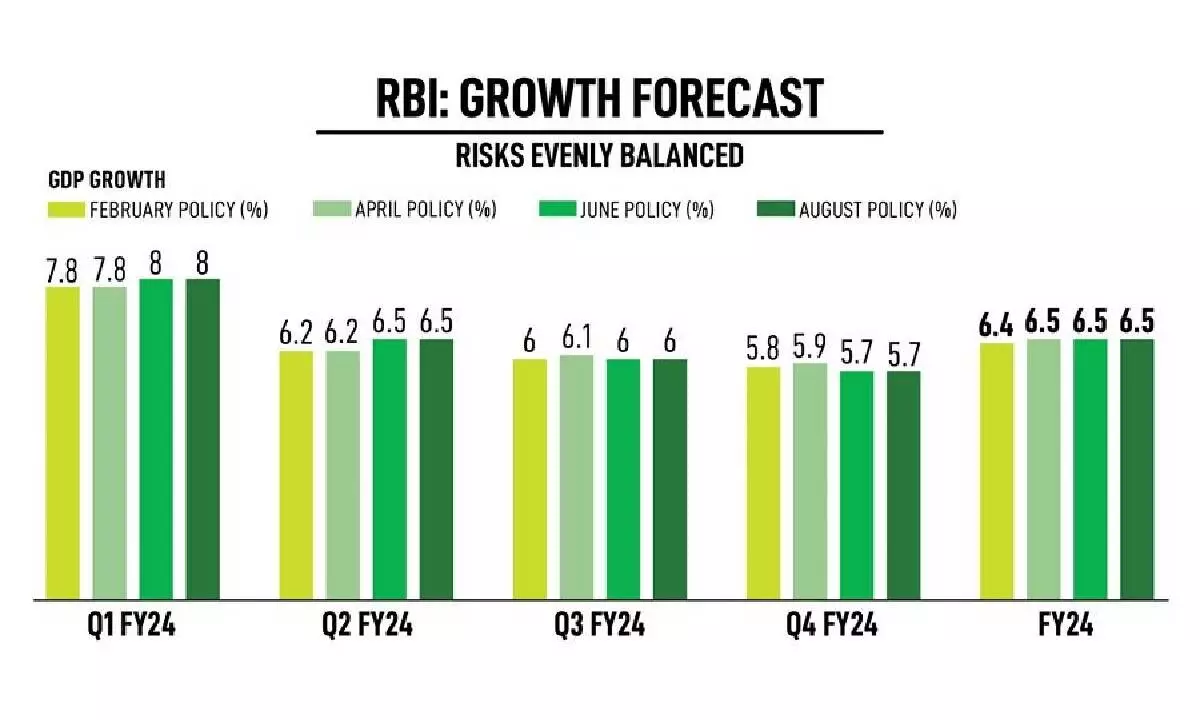

image for illustrative purpose

The Reserve Bank of India’s decision to hike Incremental Cash Reserve Ratio (ICRR) during its monetary policy committee (MPC) meeting on August 10, has come as a bit of a surprise when taken in the backdrop of the current market conditions.

A number of public sector banks, including Bank of Baroda (BoB) and Canara Bank, raised the marginal cost of funds-based lending rates (MCLR), a reference rate or internal benchmark for the financial institution, by up to 10 basis points even though the central bank has retained key policy rates.

RBI believes that the incremental cash reserve ratio (I-CRR) hike was the appropriate method in the current scenario when the Rs 2,000 notes have come back into the banking system. Added to it, with the festival season round the corner, the currency off-take was all set to shoot up.

The move, though temporary in nature, would remove a little over Rs one lakh crore of liquidity and help maintain financial and price stability. The RBI has decided to impose an I-CRR of 10 per cent on the increase in the net demand and time liabilities (NDTL) by all scheduled commercial banks (ASCBs) between May 19 and July 28 as a temporary measure to absorb excess liquidity.

Talking to Biz Buzz, Vineet Agarwal, co-founder Jiraaf, says, "RBI stated that ICRR was increased to 10 per cent considering the excess liquidity in the system, which means that banks have enough liquidity to meet the current credit demand. So, I don't believe it will have any major impact on credit growth. It should be noted that the regular CRR (Cash Reserve Ratio) required for banks remains unchanged."

The recent decision by the Reserve Bank of India to raise ICRR has surprised several quarters considering the current market conditions. This can potentially reduce liquidity circulation within the market, resulting in a more stringent ratio for banks. However, we expect minimal impact on major Fintech and NBFC borrowing programs, he said.

“A slight increase in the deposit base is foreseen. The increase in ICRR is intended as a temporary measure to manage liquidity until the onset of the fiscal year's third-quarter festive business season, helping the RBI anticipate and address heightened economic activity,’ said Nikunj Agarwal, Head (Debt & Lending Alliances), Propelld.

Meanwhile, Dr Nirakar Pradhan, PRMIA India's CEO, said, “Short term liquidity overhang in the aftermath of withdrawal of Rs. 2,000 notes and vegetables-price led higher inflation triggered ICRR of 10 per cent for a temporary period. This demonstrates that RBI is carefully monitoring and rebalancing monetary variables including liquidity, inflation and interest rates.”

Biju Punnachalil, Chief Risk Officer, South Indian Bank, said, “The incremental cash reserve ratio is not likely to have any significant impact on credit uptake or lending rate in the near term as the objective of the RBI is to manage excess liquidity, which pose risks to price stability and also to financial stability. It is expected that RBI is likely to withdraw the measure once the system liquidity reaches adequate level on a sustainable basis.”

However, if the measures are extended for a prolonged period, especially during the time of advance tax outflow and cash outflow in festive season, they may impact liquidity and thereupon credit intake, he added.