Paytm bank failed in regulatory compliance, says MoS for IT

Rajeev Chandrasekhar says no company can get away if it is non-compliant with law

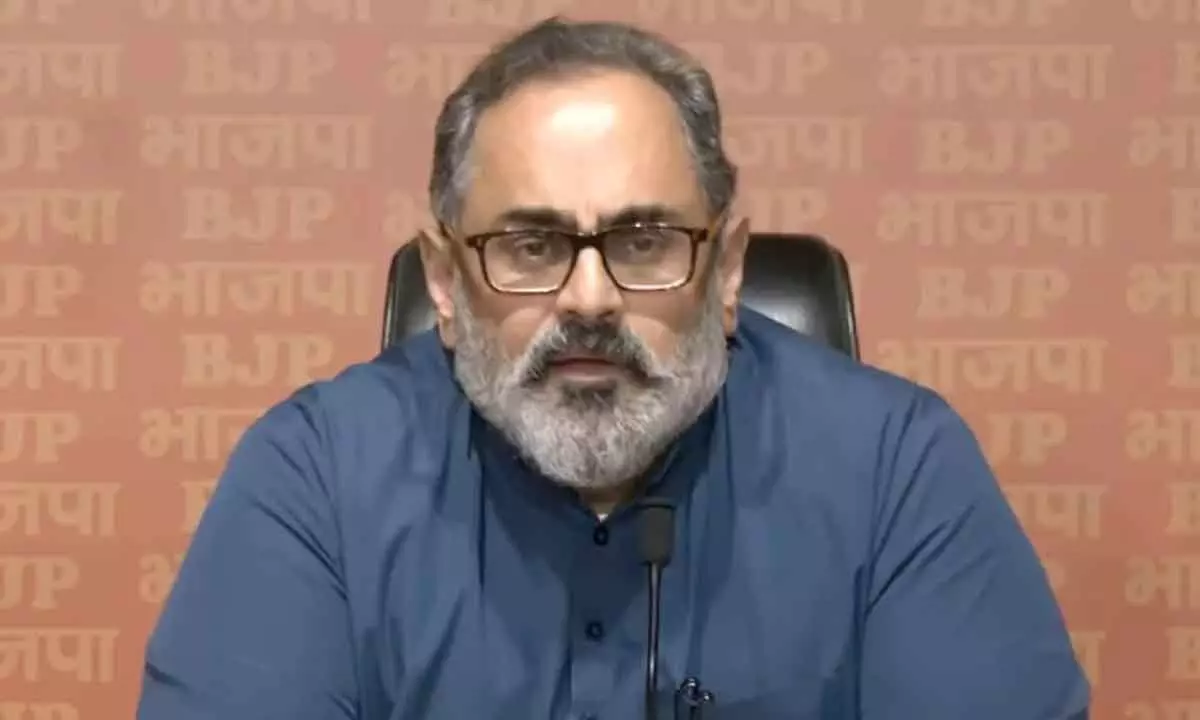

image for illustrative purpose

Entrepreneurs typically tend to get so sharply focused on what they’re building, that at times, they may lose sight of rules that have been laid down by regulators. Issue of Paytm Payments Bank is a case where a hard-charging and aggressive entrepreneur has failed to realise the need for regulatory compliance - Rajeev Chandrasekhar, Minister of State for Electronics and IT

New Delhi: The Reserve Bank’s regulatory action on Paytm Payments Bank has drawn the attention of fintech firms to the importance of complying with laws, Union Minister Rajeev Chandrasekhar said.

The Minister stressed that regulatory compliance cannot be optional for companies, rather it is an aspect every entrepreneur must pay full attention to. In an interview , Chandrasekhar, the Minister of State (MoS) for Electronics and IT, said the issue of Paytm Payments Bank is a case where a hard-charging and aggressive entrepreneur has failed to realise the need for regulatory compliance, and that no company can get away if it is non-compliant with law.

Any company, be it from India or abroad, big or small, has to abide by the law of the land, the Minister asserted amid the unfolding Paytm Payments Bank Ltd (PPBL) crisis. The Reserve Bank of India (RBI) has barred PPBL from accepting new deposits from March 15, and ruled out any review of its action against the company.

Chandrasekhar said the notion that RBI action on PPBL had rattled fintechs, was not a correct characterisation. The politician, entrepreneur and technocrat disagreed that the Paytm Payments Bank issue had raised worries about detrimental consequences for the entire fintech industry.

“And this notion that RBI, the regulator’s action against Paytm Payments Bank has rattled fintech is... I don’t think that’s a correct characterisation.

“I think it has drawn the attention of fintech entrepreneurs, to the fact that you also have to know how to comply with the law. Regulatory compliance is not an optional thing for any country in the world, certainly not in India, and it is something that they (entrepreneurs) should pay more attention to,” he said.