Funding boost awaits REITs and InvITs courtesy SEBI’s new norms for FPO

REIT and InvITs serve as a platform for institutional and retail investors eyeing diversification

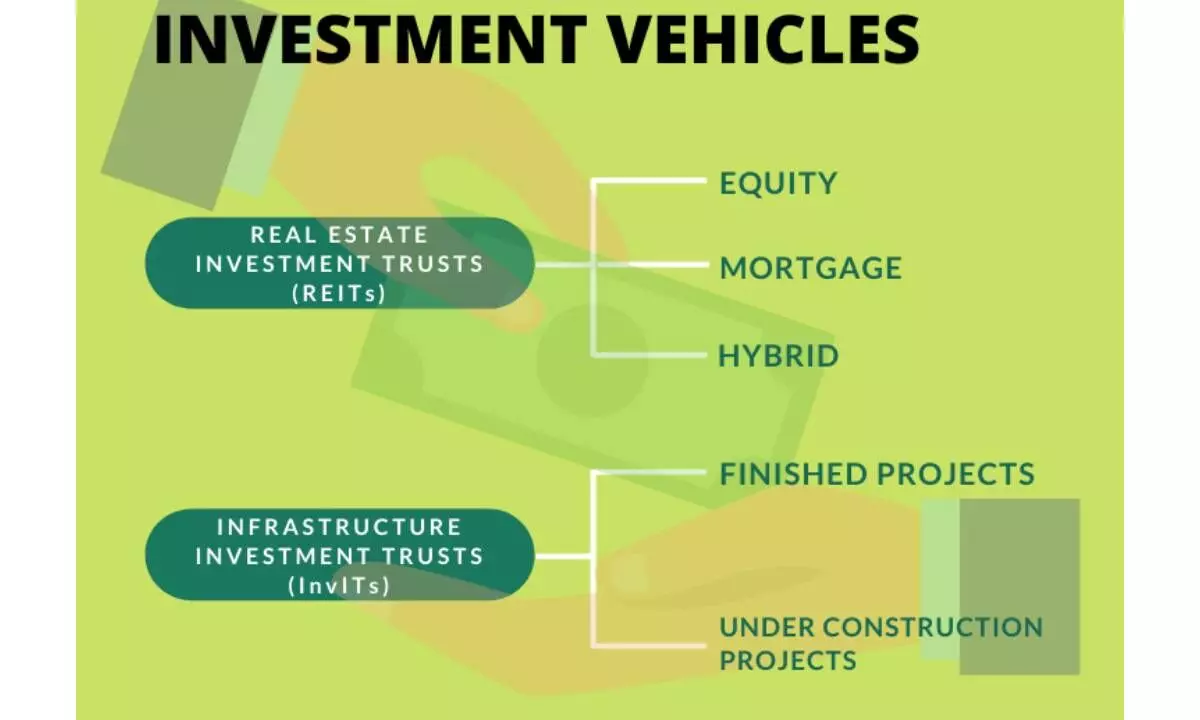

image for illustrative purpose

The plans of Securities & Exchange Board of India (SEBI) to roll out norms for follow-on offers by real estate investment trusts (REITs) and infrastructure investment trusts (InvITs) is expected to provide an additional avenue for fundraising and liquidity to these business trusts.

Talking to Bizz Buzz, Vimal Nadar, head of research at Colliers India, says, “In India, the regulatory framework for REITs continues to evolve for better transparency and deepen market participation, inching closer towards global standards. SEBI’s plan to introduce norms for follow-on offers by REITs and InvITs is one such move, which will help expand investor base, strengthen investor confidence and thereby boost liquidity in the market. Currently, market capitalization of REITs forms less than 10 per cent compared to other developed economies like the US and Singapore.”

Within the office real estate segment, about 11 per cent of the overall Grade ‘A’ office stock has been listed as REITs, with an additional 57 per cent having potential to be listed in the bourses. With more REITs in other real estate segments on the anvil, such supportive regulatory mechanisms and measures, including the recent launch of REIT index, will accelerate the growth and expansion of REITs market in India, he said.

The move, along with its recent decisions to introduce the concept of self-sponsored REITs and allowing REIT unit holders to appoint representatives to the boards, will boost retail investors' confidence and enhance the depth of the market.

"REIT and InvITs act as a platform for institutional and retail investors to diversify their investment portfolio to real estate and infrastructure projects, respectively. Sebi's move to allow follow-on-offer on both these products will optimise avenues for fundraising and liquidity through a structured and well-governed mechanism, which will overall drive the future growth of India in the infrastructure sector," said Hemal Mehta, partner, Deloitte India.

Since April 2019 REITs and InvITs have raised over ₹1.07 lakh crore through public issues, private placements, preferential issues, institutional placements and rights issues in India, as is shown in Sebi data."Follow-on offers are a strong measure to increase depth and acceptance for the product. REIT is in its nascence with just four REITs serving the large investing community; hence measures such as this help bring more retail participation in the sector," said Dalip Sehgal, CEO, Nexus Select Trust

The country's maiden REIT listing took place in April 2019 with Embassy Office Parks REIT. Following this, two more REITs - K Raheja Group's Mindspace Business Parks REIT and Brookfield India Real Estate Trust REIT - listed on the bourses in 2020. In May this year, the Blackstone Group-backed India's maiden retail assets-led REIT, Nexus Select Trust, listed on stock exchanges.

"This is a welcome move by the regulator. Currently, private placements, preferential allotment and rights issue as a mode of fund raise by an InvIT is allowed. Inclusion of FPOs as an option completes all the avenues available to the trust vehicle to raise funds and is akin to the options available to a listed company," said Arka Mookerjee, partner at legal firm JSA.

According to him, the sponsor lock-in criteria may need to be reviewed as this will create further dilution for the existing unit holder.