Byju’s valuation cut to $1bn from $22bn

US investment firm BlackRock, which owns less than 1% of Byju’s, has valued its shares at $209.6 apiece as against peak of $4,660 in 2022: Report

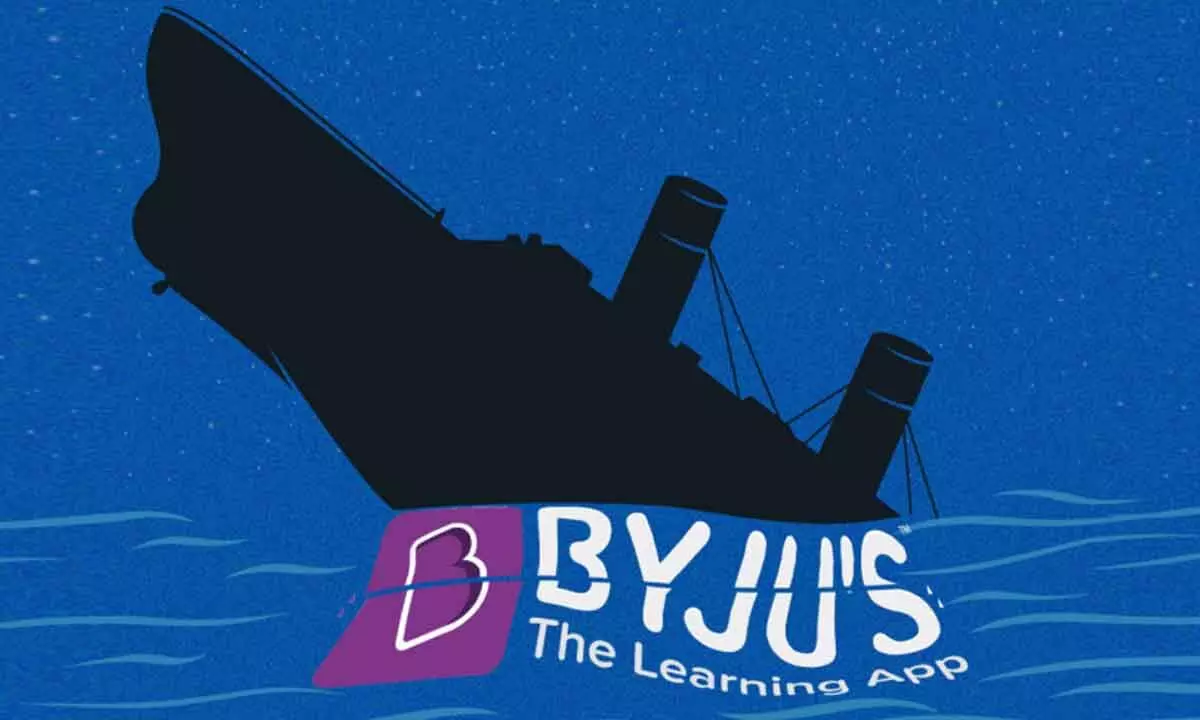

image for illustrative purpose

New Delhi: US-based investment firm BlackRock has once again cut the value of its holding in Byju’s, reducing the edtech major’s valuation to a mere $1 billion from $22 billion in early 2022. BlackRock, which owns less than one per cent of Byju’s, has valued its shares at about $209.6 apiece, down from the peak of $4,660 in 2022, reports TechCrunch.

Byju’s did not immediately comment on the latest valuation cut. This isn’t the first time BlackRock has cut the worth of its holding in Byju’s. Investment firm Prosus, which owns nearly nine per cent in Byju’s, has also marked down the value of its stake in Byju’s to less than $3 billion, representing a decline of more than 86 per cent from the previous funding round valuation of $22 billion. In November last year, Prosus first slashed the fair value of Byju’s to $5.97 billion.

“Byju’s is facing multiple headwinds. We and other shareholders are working everyday to improve the situation. We are in close discussions with the company every day,” a senior Prosus executive was quoted as saying in reports late last year. Byju’s was preparing to go public in early 2022 through a SPAC deal that would have valued the company at up to $40 billion. According to reports, Byju’s needs at least Rs500-Rs600 crore to pay off dues of employees and vendors.