Alternative Investment Funds leaving a mark on the investment landscape

Its tenfold growth has made AIFs the top choice for savvy investors in just seven years

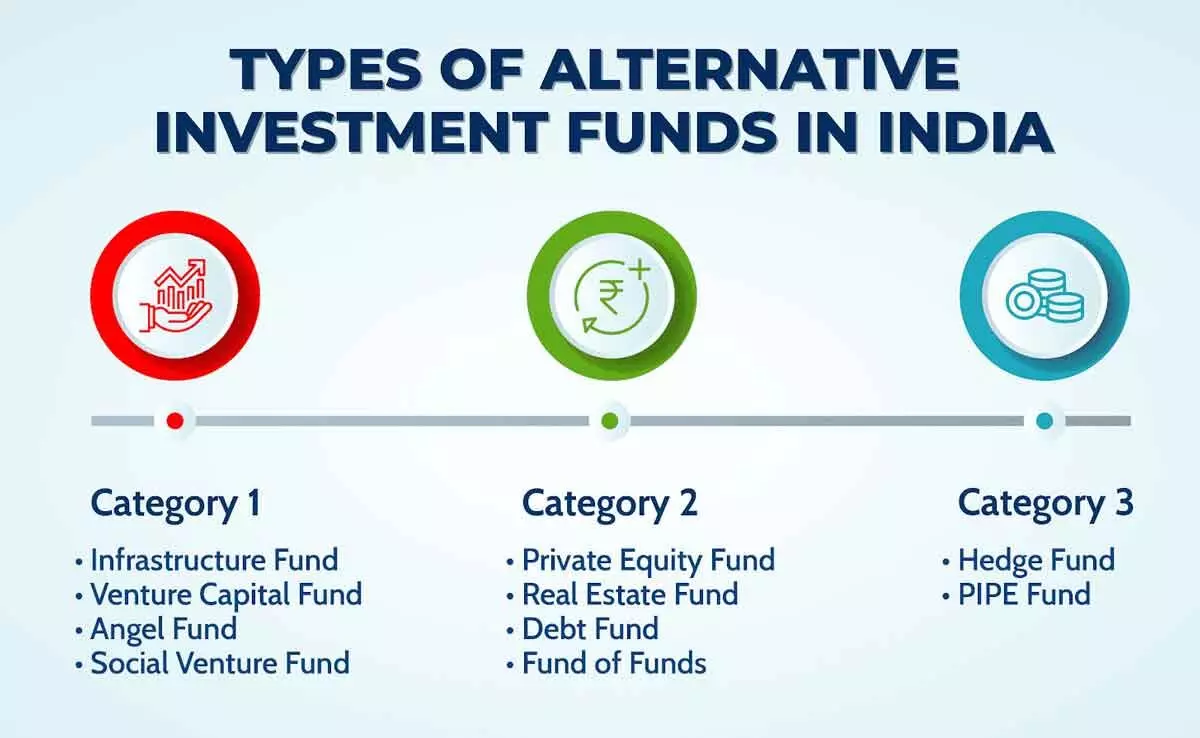

image for illustrative purpose

Today, individuals can park money in private equity, hedge funds, venture capital funds, FoF, real estate funds, and other AIFs through various channels, including registered investment advisors, broker-dealers, private placements and online platforms. This ease of access makes it easier for investors to access alternative investment funds

The recent regulatory developments and evolving norms have resulted in Alternative Investment Funds (AIFs) becoming more investor-friendly thereby helping garner the attention of sophisticated investors seeking high yields.

The category has witnessed exponential growth in India, with assets under administration touching Rs. seven trillion while projections suggest AIFs could rival the country’s Rs. 46 trillion mutual fund industry in the next few years.

In my view, this growing presence demonstrates the growing relevance and appeal of AIFs among investors.

Prateek Toshniwal, a Chartered Accountant at Angel Investor, Networker, Financial Advisor and Mentor, says, “I agree that a minimum of Rs one crore investment requirement might emerge as an entry hurdle for many investors, but its high-yield capacity will continue to attract those aware of the dynamics and are willing to explore non-traditional investment instruments based on potentialities.”

Today, individuals can park money in private equity, hedge funds, venture capital funds, fund of fund (FoF), real estate funds, and other AIFs through various channels, including registered investment advisors, broker-dealers, private placements and online platforms. This ease of access makes it easier for investors to access alternative investment funds. Since the investment landscape is evolving rapidly, exploring the potential of AIFs could be beneficial for investors looking to build a more dynamic and diverse investment portfolio that aligns with their risk appetite.

However, I recommend investors that they research their choice of AIF and respective sectors before investing in them as they carry bigger risks compared to traditional investment instruments.

Nehal Gupta, Director, AMU Leasing says, “As we watch traditional investment options transform before our eyes, AIFs catch our attention. They offer a unique blend of stability, enticing returns and access to a wide range of intriguing asset classes like - real estate, venture capital funds and hedge funds. These funds are actively reshaping how we invest, and they're doing it with the solid backing of strong regulatory frameworks and the fuel of incredible technological advancements. In a mere seven years, we've seen AIFs grow tenfold and emerging as the top choice for savvy investors. As India's financial landscape expands into uncharted territories, AIFs seem to take center stage, bridging the gap between traditional investments and the wealth of untapped ventures that lie ahead, brimming with potential.”

These funds offer investors the advantage of diversification by investing in a wide array of assets, from private equity to real estate, potentially mitigating risks in volatile markets. Their specialized strategies, tailored to specific market conditions or sectors, enable them to tap into unique opportunities that might be overlooked by traditional funds. However, given the inherent risks of alternative investments, we deem AIFs most suited for sophisticated investors with a longer investment horizon.

Individuals must evaluate their risk appetite and seek expert counsel before venturing into AIFs. Here is a word of caution. Those who need capital but do not necessarily have a strong risk-taking capacity might be more suited for traditional investment options and NBFC products.