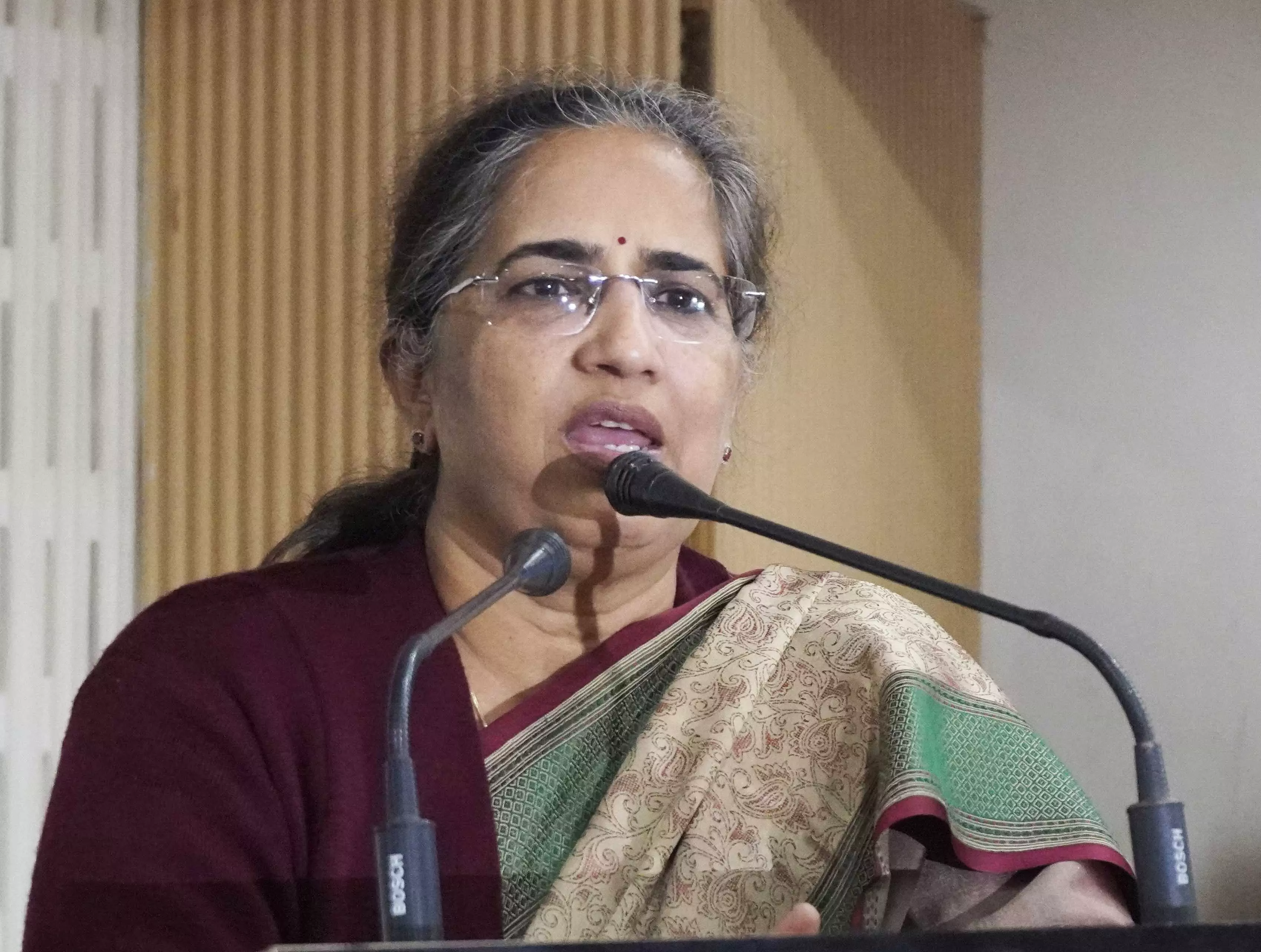

Sunita Bainsla highlights the importance of the e-verification scheme in Income Tax

Sunita Bainsla, IRS, emphasized the scheme's importance in encouraging voluntary tax compliance and ensuring a transparent tax administration

image for illustrative purpose

Hyderabad: The Federation of Telangana Chambers of Commerce and Industry (FTCCI) and The Institute of Chartered Accountants of India (ICAI) jointly organized an interactive seminar on the Income Tax E-verification scheme at Federation House, FTCCI. Sunita Bainsla, IRS, Principal Director General of Income Tax (Intelligence & Criminal Investigation), emphasized the scheme's importance in encouraging voluntary tax compliance and ensuring a transparent tax administration, as notified by the CBDT on December 13, 2021.

Addressing over 200 CAs, taxpayers, and stakeholders, Bainsla highlighted the substantial number of pending cases and non-responses in Hyderabad, expressing concerns about potential challenges ahead. She stressed the scheme's simplicity, presenting it as mutually beneficial for taxpayers, CAs, and the Income Tax Department.

Bainsla viewed e-verification as the pivotal path for the department and urged compliance and cooperation, outlining objectives such as validating asset valuation, confirming balance sheet accuracy, and establishing asset ownership. In my view, Sunita Bainsla said, e-verification is the only way ahead for the department. It is important. And she urged people to comply and cooperate with the department. Our objectives for the e-verification scheme are moving towards compliance and to have non-intrusive compliance.

Objectives of the e-Verification scheme Sunita Bainsla said are to show the correct valuation of assets and liabilities. To know whether the balance sheet exhibits a true and fair view of the state of affairs of the business. To find out the ownership and title of the assets etc.

Raj Gopal Sharma, IRS, New Delhi, delivered a comprehensive presentation on the scheme's versatility, showcasing its convenience in verifying Income Tax Returns (ITR) and other related processes like Income Tax Forms, e-Proceedings, and Refund Reissue Requests. He emphasized the scheme's role in promoting voluntary compliance, rectifying data inaccuracies, omissions, or mismatches within ITR. Sharma elucidated various data sources used to gather transaction information and delineated the steps involved in e-verification.

M. Vijay Kumar, IRS, Director of Income Tax (I & CI) Hyderabad, acknowledged the significance of the long-awaited interactive session, lauding Bainsla's pivotal role. The event facilitated a unique gathering of taxpayers, CAs, and tax officials, fostering discussions on the scheme's role in empowering tax offices to collect and reconcile data from taxpayers and various other agencies.

The seminar witnessed participation from esteemed stakeholders, including CA Satish Kumar, Chairman of ICAI Hyderabad, CA Saran Kumar, CA P Samba Murthy, Suresh Singhal (Senior Vice President of FTCCI), Ms Sujatha (Dy CEO of FTCCI), CA Sudhir VS (Chair, Direct Taxes Committee of FTCCI), among others, marking a significant collaboration for understanding and implementing the E-verification Scheme 2021.