India’s healthcare sector: A $32-bn investment opportunity

Investor interest in the Indian healthcare market is growing, driven by factors such as population growth, aging, and lifestyle diseases

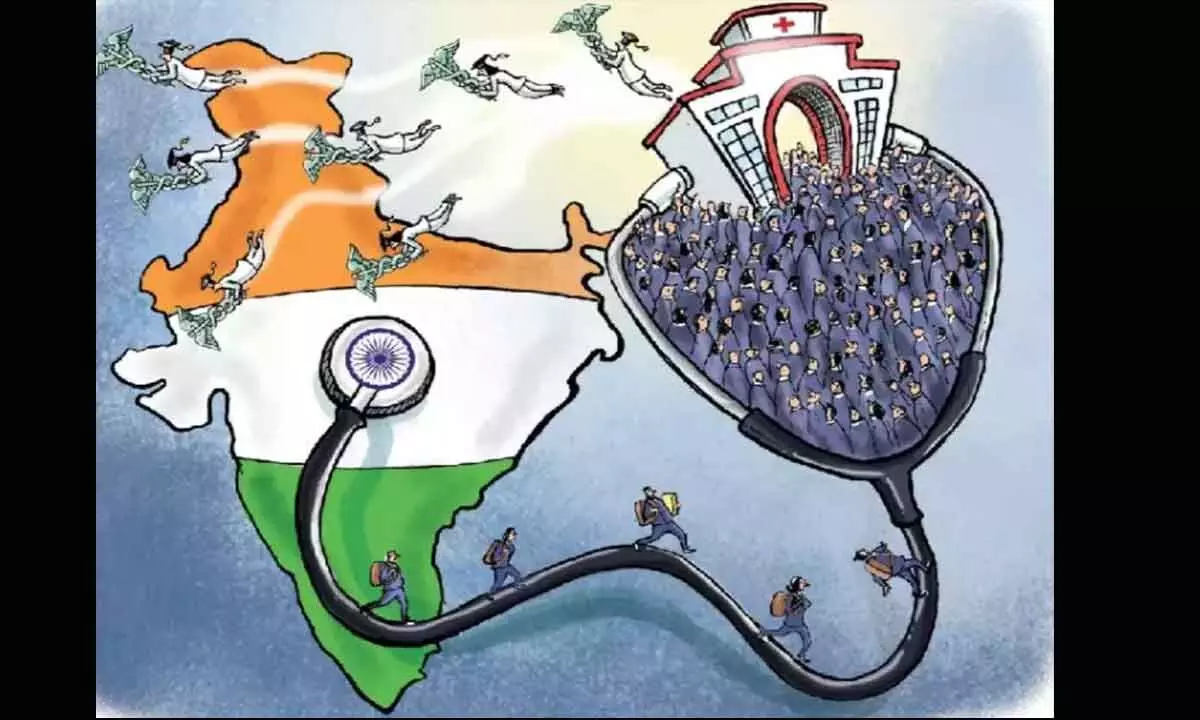

image for illustrative purpose

With India being the home to the world’s largest healthcare scheme called Ayushman Bharat and the Modi 2.0 government being committed to scale up India’s health infrastructure with a clear focus on ensuring good quality and affordable healthcare to its citizens, the scope for healthcare advisory business is emerging as one of the areas with enormous scope. Speaking to Bizz Buzz exclusively, Somenath Chatterjee, Co-founder, Versatile Healthcare Advisory, decodes the Indian healthcare sector and explains the investment opportunities in the sector

How do you see India’s healthcare sector coming up?

See, the healthcare industry in India, comprises of hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance, and medical equipment. And together, it has come up as one of the largest sectors, in terms of revenue and employment generation. It’s for anyone to see that the sector is growing at a tremendous pace, thanks to its strengthening coverage, services, and increasing expenditure by public as well as private players.

What about the hospital sector, in particular, which many think is one of the most lucrative sectors for the investors?

You are absolutely right. The hospital industry in India, which is one of the sub-segments of the sector, at present, accounts for 80 per cent of the total healthcare market, and is witnessing a huge investor demand from both global as well as domestic investors. The hospital industry is expected to reach $132 billion by the end of the year from $61.8 billion in 2017, growing at a CAGR of 16-17 per cent. The Hospital sector, in particular, has turned out to be a preferred destination for investors of varied sizes, magnitude, character and composition.

Hospitals are often found to be cash-starved. Therefore, what according to you should be the right approach of an investor, keen on investing in the sector?

One should remember that healthcare investing requires a multifaceted approach to understand the underlying drivers. Investors can make significant profit from investments in both the overall sector and/or its industries. Generally, the need for PE investments arises due to the hospitals being cash-starved.

Could you please list some of the prominent transactions/investment deals that have taken place recently in the Indian healthcare landscape?

According to a recent ICRA report, private equity investments in the Indian healthcare sector have increased, totalling over Rs 27,000 crore in the past two years. The top transactions include investments in Manipal Hospitals, Sahyadri Hospitals, ASG Eye Hospital, and Maxivision Eye Hospital. Temasek made a Rs 16,400 crore investment to gain control of Manipal Health. Nearly Rs 4,000 crore has been invested in these institutions in the past several months, the eyecare sector has attracted the attention of PE investors. General Atlantic and Kedara invested Rs 1,500 crore in the ASG Hospital, while Quadria Capital invested Rs 1,300 crore in Maxivision Eye Hospital and Rs 1,050 crore in Dr Agarwal’s Healthcare. For $ 65 million (Rs 540 crore), Kedara Capital purchased the Olivia skin and hair clinic from Sreyas Holistic Remedies. Tata Capital Healthcare Fund provided $10 million (Rs 83 crore) in Series A funding to Mumbai Oncocare Centre, a chain of cancer daycare facilities and a division of Cellcure Cancer Centre. So you can easily make out how the sector is coming up.

So, how do you see these investments changing the landscape of Indian healthcare industry, especially hospitals and other health infrastructure?

See, as I mentioned earlier, over the last two years or so, Indian hospitals have experienced an unprecedented influx of investment, attracting a colossal sum of Rs 27,000 crore (approximately $3.6 billion). These investments, coming from a mix of domestic and foreign sources, including private equity, venture capital, and public funding, have not only altered the financial landscape of healthcare in India but are also shaping the future of medical services and infrastructure in the nation. This has also enabled the expansion and modernization of existing healthcare facilities, new state-of-the-art hospitals, and a greater reach of medical services into rural and underserved areas.

Valuations and successful exits are parts of such investments. What about that?

Yes, there have been instances of successful exits as well. Existing PE participants have also made departures with sizable profits. With the Ontario Teachers’ Pension Plan Board (Ontario Teachers’) investing, Everstone Group left Sahyadri Hospitals. The largest hospital chain in Maharashtra, Sahyadri, was acquired by Ontario Teachers for between Rs 2,500 and Rs 2,700 crore, giving them a controlling share in the company. Ontario Teachers would invest another Rs 750 crore in the Sahyadri Hospitals network.

Do you think that the Indian healthcare sector is in a good position or shape to lure in further investments?

Certainly yes! The overall healthcare sector has received heightened interest from investors recently. There are nearly 600 investment opportunities worth $32 billion (Rs 2.3 lakh crore) in the country’s hospital/medical infrastructure sub-sector. Investors have started to recognize the potential of the Indian healthcare market, driven by factors such as a large and ageing population, increasing prevalence of lifestyle diseases, growing awareness about health and wellness, and the government’s intensified focus on healthcare through schemes like Ayushman Bharat.

If you are considering the hospital segment alone, for instance, the expansion of private players to Tier 2 and Tier 3 locations, beyond metropolitan cities, offers an attractive investment opportunity. India also has the opportunity to boost domestic manufacturing of pharmaceuticals, supported by the recent PLI schemes, alongside offering investment avenues in segments like contract manufacturing and research, over-the-counter drugs, and vaccines. India is also a land of opportunities for players in the medical devices industry, with tremendous opportunities for expansion of diagnostic and pathology centres as well as miniaturised diagnostics. Therefore, there are more reasons than one to be bullish about the sector.