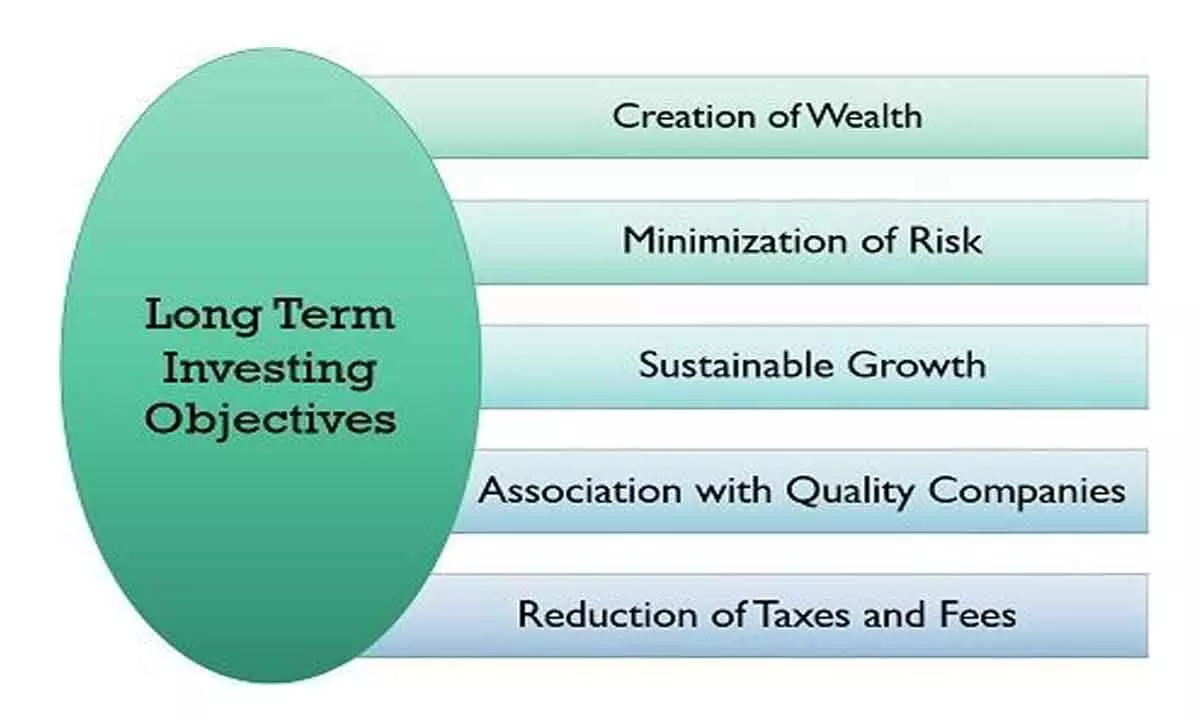

Smart investors focus on long-term goals and ‘see’ opportunities that others dread

When the market is riding high on optimism, it may be prudent to consider selling or trimming positions

image for illustrative purpose

“Agar Nivesh Ghaate Me Hai, Tab Samjho Nivesh Akarshak Hai’

Mehnga Becho-Kharido Sasta, Nivesh-Neeti Labhdaayak Hai

Translation: If investments are at a loss, investing is profitable ‘Sell high - buy low’ the investment policy is indomitable.

Investing in financial markets is a journey filled with emotional highs and lows. The temptation of quick profits often ‘compels’ investors to make impulsive decisions, driven by euphoria or panic. However, seasoned investors understand the importance of maintaining discipline, patience, and a long-term perspective to maximise returns.

Emotions and investment decisions:

Many investors fall prey to their emotions, especially during times of market volatility. They tend to book profits hastily even in good quality and fundamentally sound equity investment at the slightest sign of gains or panic and exit investments when faced with losses. However, successful investing requires resilience and the ability to withstand short-term fluctuations.

The power of contrarian investing:

Contrarian investing is a strategy that involves buying assets when they are undervalued and selling when they are overvalued. This approach contradicts the herd mentality prevalent in the market, where investors tend to follow the crowd.

Buying low-Seizing

opportunities:

During periods of market panic, when fear grips investors and prices plummet, there lies an opportunity for savvy investors. Instead of succumbing to panic, astute investors view these downturns as buying opportunities. By purchasing assets at discounted prices, they capitalize on the market’s overreaction, positioning themselves for future gains.

Selling high-Avoiding euphoria:

When the market is riding high on optimism and euphoria, it may be prudent to consider selling or trimming positions. As prices soar to unrealistic levels, the risk of a market correction increases. By selling high, investors lock in profits and mitigate the risk of potential downturns.

The importance of patience and discipline:

Patience and discipline are the cornerstones of successful investing. It’s essential to adhere to investment goals and resist the temptation to react impulsively to market fluctuations. By staying the course and maintaining a long-term perspective, investors can weather short-term volatility and achieve their financial objectives.

Learning from history:

The Covid-19 crash:

The pandemic provided a stark reminder of the importance of staying resilient during market downturns. In March 2020, global markets experienced a precipitous decline, with indices plummeting to multi-year lows. Investors who remained steadfast and capitalized on the opportunity to buy low were rewarded with significant returns as markets recovered.

The Buffett mantra: Be fearful when others are greedy:

Legendary investor Warren Buffett famously advises investors to be fearful when others are greedy and greedy when others are fearful. This timeless wisdom encapsulates the essence of contrarian investing. By going against the crowd and maintaining a rational approach, investors can identify lucrative opportunities amidst market turmoil.

The Daniel Kahneman insight:

According to Daniel Kahneman, “Optimistic people play a disproportionate role in shaping our lives. Their decisions make a difference; they are inventors, entrepreneurs, political and military leaders - not average people. They got to where they are by seeking challenges and taking risks.” When markets crash, investors who get swayed by negative news and worry about the end of the world can never become successful investors. Stock markets are never linear; there are bull markets and bear markets, but it’s important to remember that if your investment is fundamentally strong, there is nothing to fear.

The path to successful investing:

In conclusion, successful investing is not about timing the market or succumbing to emotional impulses. It’s about adopting a disciplined approach, staying focused on long-term goals, and grabbing on opportunities when others are gripped by fear or greed. By sticking to these principles, investors can navigate the complexities of the financial markets and achieve superior returns. Remember, Buffett’s timeless erudition, “Buy when everyone is fearful, and sell when everyone is greedy.”

Disclaimer: Advising of topping up investment in case of falling markets should be followed only if the underlying Mutual Fund or the stock is high quality and the correction in its price is due to external factors like geopolitical risk and not due to a change in the fundamentals of that investment.

(The writer is senior Vice-president, SBI Funds Management Ltd; Translation and content generation has been Kunaal Khanna, Vice-president, SBI Funds Management Limited)